1s 8.3 where is the accounting policy. Setting the accounting policy parameters. Provisions for doubtful debts are formed

1C Accounting - setting up accounting policies in this program has its own characteristics for different tax regimes. Where can I find the accounting policy in 1C Accounting? What to pay attention to while working? In our material, we will give a step-by-step algorithm for setting up accounting policies in 1C for enterprises using the general system and UTII, and also talk about the features of policy settings for companies using the simplified tax system.

The process of setting up the accounting policy of an organization that applies the OSN is preceded by the correct filling of its initial details in the “Organizations” section (including information about the applied taxation system).

Then you need to make settings in the tabs offered by the program:

- "Stocks";

- "Expenses";

- "Reserves".

Let's take a look at the process of setting up some of these tabs.

"Income tax"

The setup process includes:

- Check the box in the line “PBU 18/02 “Accounting for income tax calculations” is applied” if the organization is obliged to apply PBU 18/02 or applies it voluntarily, having provided for such a condition in its accounting policies.

- Choosing a method for calculating depreciation in tax accounting. In the drop-down list, you must choose the option provided for by the accounting policy (linear or nonlinear - clause 1 of Article 259 of the Tax Code of the Russian Federation).

- Choosing a method for repaying the cost of workwear and special equipment. The second method from the list - “Similar to the method adopted for accounting” - will make it possible to bring the procedure for tax write-off of this type of property closer to the accounting one and avoid differences under PBU 18/02.

- Distinction between direct and indirect costs in the “Methods for determining direct production costs in OU” tab. The direction of their write-off depends on this: to account 90.02 (direct expenses) or 90.08 (indirect expenses).

"VAT"

This section of the accounting policy is configured in the program according to the following algorithm:

- Check the box if the organization has the right to be exempt from VAT (under Article 145 or 145.1 of the Tax Code of the Russian Federation) or leave the field blank if there is no such right.

- Check the boxes in the lines “Separate accounting of incoming VAT” and “Separate accounting of VAT on account 19...” if the organization combines taxable and non-taxable transactions.

- Check the box “Calculate VAT on shipment without transfer of ownership.” This means that VAT will be charged and an entry will be made in the sales book at the time of shipment of goods, regardless of the transfer of ownership. This approach corresponds to the Tax Code of the Russian Federation and the position of officials of the Ministry of Finance (letters dated 03/11/2013 No. 03-07-11/7135, dated 02/09/2011 No. 07-02-06/14, dated 09/08/2010 No. 03-07-11/379) .

For information about when an organization can legally deduct “advance” VAT, read the article “Acceptance for deduction of VAT on advances received” .

"UTII"

To configure the tab you will need:

- Check the box in the line “The organization is a payer of the single tax on imputed income (UTI)” and mark the line “Retail trade has been transferred to the payment of UTII”, if this corresponds to the accounting policy.

- From the drop-down list, select the base for distributing expenses by type of activity - “Income from sales” or “Income from sales and non-operating”.

This material will help you distribute expenses when combining tax regimes “How to properly maintain separate accounting for OSNO and UTII?” .

The nuances of setting up accounting policies in simplified terms

Companies using the simplified system are required to keep accounting records (clause 1 of the law on accounting dated December 6, 2011 No. 402-FZ). They are also not exempt from the obligation to maintain tax records.

Find out how to organize simplified accounting from the material “Procedure for maintaining accounting records under the simplified tax system (2018)” .

To set up accounting policies for tax purposes on the “Accounting Policies” tab you will need:

- Find the “STS” tab and fill in the necessary details - the date of transition to the simplified system and the number of the notification received from the tax authorities.

- Provide for control of the transition period in accordance with paragraph 1 of Art. 346.25 of the Tax Code of the Russian Federation (if the company has switched to the simplified tax system from the accrual method) by checking the box provided for this.

- In the drop-down list, select the object of taxation “income” or “income minus expenses” in accordance with the received tax notice.

NOTE! There is no need to manually set the simplified tax rate (if it is 6% or 15%): it is set automatically depending on the selected tax object. However, if the law of a constituent entity of the Russian Federation provides for the possibility of reducing it, you will need to enter the tax rate manually.

Read about the rates used to calculate the simplified tax system.

- Open the “Procedure for recognizing expenses...” tab. It is filled out by “simplified people” with the object “income minus expenses”, placing checkboxes in the boxes opposite the names of expenses that reduce the base of the simplified tax system.

Find out about the procedure in which “simplified” expenses are recognized from the article “List of expenses under the simplified tax system “income minus expenses”” .

- Make other necessary settings (when combining the simplified tax system with UTII, when the taxpayer executes commission agreements).

Correctly setting up the “Accounting Policy” tab contributes to the correct operation of the program and the generation of reliable information about the organization’s tax obligations.

Results

The use of computer programs to carry out the accounting process requires setting up accounting parameters in accordance with the accounting policies adopted by the organization. Correct setup will significantly facilitate accounting work and make it possible to generate reliable accounting information and reporting without any problems.

Before describing the elements of accounting policy, we note the following point. Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation provides two methods for determining income and expenses. These are the accrual method and the cash method. The cash method has restrictions on its use provided for by law. Simply put, not all organizations and individual entrepreneurs have the right to use it. The accrual method can certainly be used.

Attention. The 1C Accounting 8 program uses the accrual method. It cannot be replaced by the cash method of determining income and expenses. You need to come to terms with this.

The accounting policies of organizations are described in several information registers.

- Methods for distributing general production and general business expenses of organizations. Periodic within a month independent register of information.

- The order of divisions for closing accounts. Periodic within a month register of information subordinate to the registrar “Establishing the order of divisions for closing accounts.”

- Methods for determining direct production costs in tax accounting. Periodic daily independent register of information.

- Accounting policy (personnel)

- Accounts with a special revaluation procedure (accounting). Not a periodic register of information.

- Counter production of products (services) and write-off of products for own needs. Periodic within a month independent register of information.

The information register “Accounting policies of organizations” can be called the main control panel for setting up accounting policies. It contains links to many of the information registers listed above. This means that it is not necessary to open these registers separately for editing. They can be filled in during the process of setting up the “Accounting Policies of Organizations” register.

1. Register of information “Accounting policies of organizations”

The frequency of the information register “Accounting policies of organizations” is one year. This means that entries in this register can be changed no more than once a year. If an organization annually or over a long period changes its accounting policy, then it is registered with the corresponding entries in this register.

The information register form “Accounting policies of organizations” consists of several tabs. The set of details on them is determined by the state of the “Setting up accounting parameters” form.

Attention. Before setting up the accounting policies of organizations, be sure to correctly fill out the “Setting up accounting parameters” form.

1.1. “General information” tab

The state of this tab is determined by the accounting settings.

Props "Organization".

The information register “Accounting policies of organizations” describes the accounting policies for all organizations of the enterprise. However, each entry in this register always belongs to a specific organization. This is a required requirement.

Props “Applicable from ... to.”

The user specifies only the start of the new entry. The program automatically sets its end on December 31 of the year the entry begins. If in the coming new year the accountant did not enter a new entry, that is, he left the previous accounting policy in effect, then the program in the “by” attribute will automatically be set to December 31 of the new year. And so on.

Group of radio buttons “Taxation system”.

If in the “Setting up accounting parameters” form, on the “Taxation systems” tab, the “All taxation systems” radio button is activated, then for any organization and for any individual entrepreneur you can select the OSN or the simplified tax system.

If in the “Setting up accounting parameters” form the radio button “Simplified taxation system” or “Personal income tax of an individual entrepreneur” is activated, then there will be no choice in the accounting policy.

Requisite “A special taxation procedure is applied for certain types of activities.”

Setting this flag means that, regardless of the taxation system used, this organization has activities subject to a single tax on imputed income, UTII. Setting this flag will display the “UTII” tab for additional settings.

Group of checkboxes “Types of activities”.

If in the “Setting up accounting parameters” form, on the “Types of activities” tab, the “Production of products, performance of work, provision of services” and “Retail trade” flags are set, then in the accounting policy of a particular organization it will be possible to set or refuse these types of activities.

On the contrary, if the flags “Production of products, performance of work, provision of services” and “Retail trade” are cleared, then similar flags will not be displayed in the accounting policy. As a result, the accountant will not be able to set production activities and/or retail trade in the accounting policy.

Attention. If the “Production of products, performance of work, provision of services” and “Retail trade” flags are cleared in the “Setting up accounting parameters” form, then under no circumstances reflect production activities and retail trade in the program. This will lead to errors in the infobase when closing the month.

1.2. Bookmark "STS"

The “STS” tab is displayed if the simplified taxation system, STS, is installed on the “General Information” tab.

Object of taxation.

An organization or individual entrepreneur using the simplified tax system pays a single tax. Its rate is determined by the object of taxation.

- Income. The single tax rate is 6%. Allows you to choose any method of writing off material assets: Average or FIFO.

- Income reduced by expenses. The single tax rate is 15%. When you select this option, an additional Expense Accounting tab will appear. You can write off material assets only using the FIFO method.

Details “Date of transition to simplified tax system”.

According to paragraph 1 of Art. 346.13 of the Tax Code of the Russian Federation, organizations and individual entrepreneurs who wish to switch from the OSN to the simplified tax system must submit an application in the period from October 1 to November 30 of the year preceding the year from which they switch to the simplified taxation system. That is, the transition date is always January 1 of the first year of application of the simplified tax system.

Form No. 26.2-1 “APPLICATION on the transition to a simplified taxation system” was approved by order of the Federal Tax Service of Russia dated April 13, 2010 N MMV-7-3/182@ “On approval of document forms for the application of a simplified taxation system.”

Flag “Control of provisions of the transition period”.

It is likely that after the transition to the simplified tax system, the organization has unfinished contracts that began last year under the simplified tax system. In paragraph 1 p. 346.25 of the Tax Code describes the amounts that are included or excluded from the tax base under such agreements.

For example, an organization, while on the simplified tax system, received an advance payment under a contract, the execution of which is completed after the transition to the simplified tax system. When the “Control of provisions of the transition period” flag is set, the program will include this amount of money in the tax base on the date of transition to the simplified tax system.

Notification of the transition to a simplified taxation system.

After submitting an application for transition to a simplified taxation system in Form No. 26.2-1, the taxpayer must receive a “Notification of the possibility of applying a simplified taxation system” in Form No. 26.2-1. The details of this form should be indicated in this section.

Chapter 26.2 of the Tax Code of the Russian Federation does not contain a norm obliging the tax authority to confirm the possibility or impossibility of applying the simplified tax system. If an organization complies with all the restrictions established in Article 346.12 of the Tax Code of the Russian Federation, it has the right to apply the simplified tax system regardless of whether it received a notification from the tax inspectorate or not.

Attention. Organizations and individual entrepreneurs who began to use the simplified tax system from the moment of their formation do not need to fill out the last three details.

1.3. Tab "Expense Accounting"

The “Accounting for Expenses” tab is displayed if “Income minus expenses” is selected as the object of taxation on the “STS” tab.

Surely many users have noticed the interesting behavior of the program. Some expenses from the list of clause 1 of Art. 346.16 of the Tax Code of the Russian Federation, as if by magic, are reflected in the book of income and expenses. And others... at least shoot yourself: they don’t want to be reflected in it! In fact, everything is very simple if all recognized expenses are divided into two groups.

- Expenses as an element of accounting policy. The conditions for recognizing such expenses are determined by the accounting policies of the organization.

- Expenses independent of accounting policies. The conditions for recognizing such expenses are clearly defined in law. They are hardcoded in the configuration. As soon as these conditions are met, the corresponding expense is automatically recognized in tax accounting.

The “Income minus expenses” tab shows expenses, the recognition of which is determined by the accounting policy of the organization.

- Material costs.

- Expenses for purchasing goods.

- Input VAT.

Material expenses, expenses for the purchase of goods and Input VAT are recognized as expenses only if all the conditions specified for them are simultaneously met.

Conditions shown in muted color are not editable. These are mandatory conditions. The presence of editable conditions is mainly due to the ambiguity of the current legislation.

1.4. Tab "UTII"

The “UTII” tab is displayed if the “A special taxation procedure for certain types of activities is applied” flag is set on the “General Information” tab.

Flag “Retail trade is subject to a single tax on imputed income.”

In paragraph 2 of Art. 346.26 of the Tax Code of the Russian Federation lists the types of activities in respect of which UTII may be applied. This includes retail trade, but with one limitation.

Retail trade carried out through shops and pavilions with a sales area of no more than 150 square meters for each trade facility is not subject to a single tax.

Distribution of expenses by type of activity, taxable or not subject to UTII.

The need to distribute expenses arises when, along with the OSN or simplified tax system, UTII is also used. In this case, those expenses that cannot be clearly attributed to the type of activity taxed by the OSN (STS) or to the type of activity taxed by UTII are distributed according to the specified method and distribution base.

- Distribution method. The distribution method is explicitly set only for the simplified tax system: “For the quarter” or “Cumulative total from the beginning of the year.”

- Distribution base. For the simplified tax system: “Income from sales (BU)”, “Income of total (IN)” or “Income received (IN)”. For OSN: “Income from sales” or “Income from sales and non-operating”.

Button “Set accounts for accounting income and expenses for activities subject to UTII.”

The button opens the information register form “Accounts of income and expenses for activities with a special taxation procedure.” By default, it already describes the necessary accounts.

It is important to remember that in the standard configuration of 1C Accounting 8, special accounts are allocated in the chart of accounts to account for activities subject to a single tax. Their name contains the word “UTII” or “...with a special taxation procedure.”

Attention. Under no circumstances should accounts intended for UTII be used in activities with DOS and vice versa.

1.5. Tab “OS and intangible assets”

The state of this tab does not depend on the accounting settings.

The method of calculating depreciation of fixed assets and intangible assets in tax accounting.

The Tax Code (clause 1 of Article 259) provides for two methods of depreciation: linear and non-linear. The taxpayer has the right to choose any of them.

However, regardless of the depreciation calculation method established by the taxpayer in the accounting policy for the depreciation of buildings, structures, transmission devices, intangible assets included in depreciation groups 8-10, the program will apply the straight-line depreciation method. This is the requirement of paragraph 3 of Article 259 of the Tax Code of the Russian Federation.

“Property tax rate” button.

This button opens the “Property Tax Rates” form, which consists of two tabs.

- Property tax rates. This tab displays entries from the periodic register of information “Property Tax Rates”. This register indicates the property tax rate applied to all property of the organization. If there is a tax benefit, it also applies to all property of the organization.

- Objects with a special taxation procedure. This tab displays entries from the periodic register of information “Property tax rates for individual fixed assets.” In some cases, legislative (representative) bodies of constituent entities of the Russian Federation may establish benefits for certain property items. In this case, the rate, benefits and other characteristics are indicated in this register for each fixed asset object.

Property tax is described in Chapter 30 of the Tax Code of the Russian Federation and has been in effect since January 1, 2004. The property tax rate is established by the laws of the constituent entities of the federation, but cannot exceed 2.2%, see paragraph 1 of Art. 380 Tax Code of the Russian Federation.

On the tabs of the “Property Tax Rates” form, you are given the opportunity to select one of the following benefits.

- Tax exemption: In Art. 381 of the Tax Code of the Russian Federation defines a closed list of organizations whose property is completely exempt from taxation. This is a federal benefit. When you select the type of organization, the benefit code is automatically set in this detail. Benefit codes are defined in the order of the Ministry of Taxes of March 23, 2004 No. SAE-3-21/224.

- Reduced tax rate to: Based on clause 2 of Art. 372 and paragraph 2 of Art. 380 of the Tax Code of the Russian Federation, legislative (representative) bodies of constituent entities of the Russian Federation have the right to establish a reduced property tax rate for certain categories of taxpayers or certain types of property. This detail indicates the value of the reduced tax rate as a percentage.

- Reducing the tax amount by: According to paragraph 2 of Art. 372 of the Tax Code of the Russian Federation, subjects of the Russian Federation have the right not only to establish a reduced property tax rate. They can determine the procedure and timing of tax payment. There is a practice when a subject of the Russian Federation, using its right, grants an organization the right to pay not all of the calculated property tax, but part of it. For example, 50%. When choosing this option, the percentage of tax reduction is indicated.

1.6. Tab "Inventory"

If in the “Setting up accounting parameters” form, on the “Inventory” tab, the “Accounting is maintained by batches (receipts)” flag is cleared, then the “By FIFO” radio button will still be displayed in the accounting policy.

This means that in the accounting policy you can select the “By FIFO” method. True, the program will warn you that you need to add the “Parties” subaccount to the inventory accounts. If you click on the “OK” button, the program will add the “Batch” subaccount to the inventory accounts.

Attention. Regardless of which option for writing off inventories is set in the accounting policy, for sales transactions without VAT or with 0% VAT, batch accounting is always maintained, see the “VAT” tab.

Simplified people with the tax object “Income” can, at their discretion, choose any write-off method: By average cost or By FIFO.

If the object of taxation is “Income minus expenses,” then there is no choice. Only FIFO! We saw above that such taxpayers must indicate the conditions for recognizing expenses on the “Accounting for Expenses” tab. Among these conditions there are mandatory conditions: “Receipt of materials” and “Receipt of goods”.

Please note that the organization pays for a specific batch of materials or goods. In other words, to recognize expenses, batch accounting of material assets is required. The write-off of material assets in batch accounting can be performed using the FIFO or LIFO method.

From January 1, 2008, the use of the LIFO method in accounting was canceled by order of the Ministry of Finance of Russia dated March 26, 2007 No. 26n. True, LIFO can also be used in tax accounting. However, for the purpose of uniformity of accounting and tax accounting, FIFO is used in both accounting and tax accounting.

In the lower half of the “Inventory” tab, developers simply inform about ways to estimate the cost of inventory for certain cases. They are stitched into the configuration.

Always written off at average cost.

- Materials accounted for in account 003 “Materials accepted for processing.”

- Goods recorded on account 41.12 “Goods in retail trade (in NTT at sales value).”

Always written off using the FIFO method:

- Goods recorded on account 004 “Goods accepted for commission”.

1.7. “Production” and “Product Release” tabs

Due to its volume, the description of the settings on these tabs became the topic of a separate article. Once it is published, a link to it will appear here.

1.8. Tab "Retail"

The “Retail” tab is displayed if the “Retail” flag is selected on the “General Information” tab.

For retail organizations in paragraph. 2 clause 13 PBU 5/01 establishes two methods of accounting for retail goods.

- By purchase price. Account 42 “Trade margin” is not used.

- By sales price. Account 42 “Trade margin” is used. In this case, for the purpose of accounting for income tax, the amount of direct expenses is determined by the cost of purchasing goods.

If an organization decides to account for retail goods at acquisition cost, then the account is used

- 41.02 “Goods in retail trade (at purchase price).”

For these goods, in the information register “Item Accounting Accounts” for the “Retail” warehouse type, you must specify accounting account 41.02 “Goods in retail trade (at purchase price).”

If the organization decides to account for retail goods at sales value, then the following accounts are used:

- 41.11 “Goods in retail trade (in ATT at sales price)”,

- 41.12 “Goods in retail trade (in NTT at sales price).”

- 42.01 “Trade margin in automated retail outlets”

- 42.02 “Trade margins in non-automated retail outlets.”

For retail goods that are accounted for at sales cost, there is no need to set up the “Item Accounts” information register. The program automatically determines the required accounting accounts depending on the type of warehouse: retail (ATT, automated point of sale) or non-automated point of sale (NTT).

Attention. In the 1C Accounting 8 program, accounting for goods at sales price is more labor-intensive than accounting for purchase price.

The fact is that in the 1C Accounting 8 program, the retail sales price is set virtually manually by the document “Setting item prices” for each item item. Then the program automatically calculates the trade margin for each item by subtracting the cost of purchasing the product from the sales price. At the end of the month, the average trading margin is calculated. It is impossible to determine in advance the trade margin for a group of goods.

To fully automate the accounting of goods at sales prices, it is better to use the 1C Trade Management 8 program. It provides the user with several algorithms for setting the trade margin for an arbitrary group of goods.

1.9. Tab “Income Tax”

The “Income Tax” tab is displayed only for organizations with a general taxation system.

Button “Specify a list of direct expenses.”

For profit tax purposes, in accordance with paragraph 1 of Article 318 of the Tax Code of the Russian Federation, all production and sales costs are divided into direct and indirect costs. This paragraph also provides an approximate list of expenses that may be classified as direct expenses.

- Material costs. According to paragraphs 1 and 4 of paragraph 1 of Article 254 of the NKRF.

- Labor costs

- Expenses for insurance premiums and contributions to the Social Insurance Fund from NS and PZ. For workers engaged in the production of goods (performance of work, provision of services).

- Amounts of accrued depreciation. For those OS objects that are used in production (performance of work, provision of services).

Expenses not included in the list of direct expenses are indirect expenses of production activities. The taxpayer independently determines in the accounting policy the list of direct expenses associated with the production of goods (performance of work, provision of services). In 1C programs this is recorded as follows.

In the 1C Accounting program 8th edition. 1.6 (not supported since April 2011) two charts of accounts: accounting and tax. In the tax chart of accounts there are direct cost accounts and indirect cost accounts. Therefore, the nature of the expense was determined by the account to which it was written off.

In the 1C Accounting program 8th edition. 2.0 unified chart of accounts. But the accounts on which it is necessary to maintain tax records have the tax accounting sign (TA). For example, on account 26 “General business expenses are a sign of tax accounting.”

In accounting, costs written off to this account are indirect. But in tax accounting they can be both indirect and direct. It turns out that there is one account, but it is somehow necessary to distinguish the nature of costs in tax accounting.

To solve this problem in the 1C Accounting program 8 ed. 2.0 is intended for the periodic register of information “Methods for determining direct production costs in NU”. It is the separator between direct and indirect costs.

Attention. Expenses listed in this register are recognized as direct expenses in tax accounting. Expenses not indicated in this register are recognized as indirect expenses.

The figure shows a fragment in the form of a selection from the debit of account 20.01 “main production” from the demonstration database.

Mandatory details of the information register “Methods for determining direct production costs in NU” are “Date”, “Organization” and “Type of expenses of NU”. The remaining details listed below are not required to be filled out.

- Subdivision.

- Account Dt. Formally, any account (not a group) can be specified as a debit account. But since this register is intended to account for production costs, it makes sense to indicate only subaccounts of cost accounts 20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses” and 26 “General expenses”.

- Kt account. An account can be specified here that corresponds to the corresponding cost account.

- Cost item.

For example, if a division is not specified, then the record applies to all divisions of the organization. If a debit account is not specified, then the entry applies to all expense accounts. Etc.

The division into direct and indirect expenses occurs at the end of the month. The regulatory document “Closing accounts 20, 23, 25, 26” compares the turnover of cost accounts with the templates in the register “Methods for determining direct production costs in OU”. For those turnovers, taking into account analytics, for which corresponding templates were found in the register, expenses will be considered direct. If the template is not found for the existing turnover, then the consumption of this turnover is considered indirect.

For example, the entry highlighted in the previous figure with a red frame means the following. Material expenses for any cost item written off to any department on account 20.01 “Main production” from any credit account are direct.

Any cost item with an expense type in the NU “Material expenses” written off from any account to the debit of account 20.01 to any department is a direct expense.

If in this entry you indicate credit account 10.01 “Raw materials and materials” and assume that there are no other entries in the debit of account 20.01 “Main production”, then the expenses written off from account 10.01 “Raw materials and supplies” will be considered direct. The program will consider all other expenses written off to the debit of account 20.01 “Main production” to be indirect.

In the information register “Methods for determining direct production costs in NU” it is impossible to store general and detailed records valid for the same period, for example, as in the figure.

- First entry (general). It means that any cost items with the expense type “Material expenses” written off to any cost account from the credit of any corresponding account in any department are considered direct expenses.

- Second entry (detailed). This entry refers to direct expenses only those expenses that are written off as a debit to account 20.01 “Main production”.

It is easy to see that the second pattern is already included in the first. But what should the program do? Which instruction should I follow? After all, one contradicts the other. One of the entries needs to be deleted.

By default, the information register “Methods for determining direct production costs in NU” is not filled in. It must be filled out. When you click on the “Specify list of direct expenses” button, the program checks for the presence of entries in this register. If there are no entries, then she will offer to fill out the register in accordance with the recommendations of Art. 318 Tax Code of the Russian Federation. The generated list is not the only correct one. Therefore, the user has the right to edit it independently, guided by the provisions of Article 318 of the Tax Code of the Russian Federation.

Attention. If there is not a single entry in the information register “Methods for determining direct production costs in OU”, then the program will consider all expenses in tax accounting to be indirect.

The regulatory document “Closing accounts 20, 23, 25, 26” divides all expenses of the period into direct and indirect. Direct expenses form the actual cost of products (works, services) in tax accounting. All indirect expenses in tax accounting are written off to account 90.08.1 “Administrative expenses for activities with the main tax system.”

Attention. You can check the correctness of the division into direct and indirect costs using the “Production Costs Accounting Register” report. It allows you to separately generate a list of direct and a list of indirect costs.

Button “Specify income tax rates”.

If, with multi-company accounting, all organizations apply the same profit tax rates to the federal budget and to the budget of a constituent entity of the Russian Federation, then in the accounting settings settings, you must uncheck the “Different profit tax rates apply” flag. In this case, the “Specify income tax rates” button will display a form as in the figure.

This is a form of a periodic register of information “Income tax rates for all organizations.” It simultaneously displays the income tax rate for the federal budget and the budget of the constituent entity of the Russian Federation.

If different organizations with multi-company accounting are registered in different subjects of the federation, and they have different income tax rates, then in the accounting settings settings you need to set the flag “Different income tax rates apply”. In this case, the “Specify income tax rates” button will display a form as in the figure.

This is also a form of the periodic register of information “Income tax rates for all organizations.” But now it can only indicate the income tax rate in the Federal Bank of the Russian Federation.

Flag “PBU 18/02 Accounting for income tax calculations is applied.”

When the flag is set, the mechanism for keeping records of permanent and temporary differences in the valuation of assets and liabilities is activated in order to comply with the requirements of PBU 18/02.

1.10. “VAT” tab

Some VAT payers are characterized by fairly simple business transactions, while others are complex. In accordance with them, VAT accounting is divided into three levels of complexity in the configuration.

- Regular VAT accounting.

- Full VAT accounting.

To maintain VAT accounting according to a simplified scheme, you need to set the “Simplified VAT accounting” flag. Simplified VAT accounting is valid only for rates of 18% and 10%. With this option, the flag “The organization carries out sales without VAT or with 0% VAT” becomes inactive. This means that with simplified VAT accounting it will not be possible to reflect transactions without VAT or at a VAT rate of 0%.

With simplified VAT accounting, only two pairs of relevant documents are used: the receipt document and the “Invoice received” document. In order for the result to be reflected in the purchase book in the “Invoice received” document, you must set the “Reflect VAT deduction” flag.

Attention. There is no need to create regulatory documents “Creating Purchase Ledger Entries” and “Creating Sales Ledger Entries”.

In organizations where the operations listed below take place, setting the “Simplified VAT accounting” flag is highly undesirable.

- Deductions for purchased fixed assets are accepted after they are put into operation.

- Certain types of activities have been transferred to the payment of UTII.

- The organization plays the role of a tax agent.

- Construction and installation work is taking place.

- Export-import operations take place.

- It is necessary to take into account positive amount differences.

Otherwise, the user will have to take control of tracking events related to the correct accounting of VAT and actually manually register them on time using the documents “Reflection of VAT for deduction” and “Reflection of VAT accrual”.

The documents “Reflection of VAT for deduction” and “Reflection of VAT accrual” are also used in cases where the receipt and sale of goods (work, services) is recorded by manual operations (accounting certificate).

Regular VAT accounting.

Regular VAT accounting, like simplified accounting, is used only for rates of 18% and 10%. To implement regular VAT accounting in the “Accounting Policies of Organizations” information register, on the “VAT” tab, you must perform the following steps.

- Remove the flag “The organization carries out sales without VAT or with 0% VAT.”

With regular VAT accounting, all restrictions on simplified VAT accounting are removed, with the exception of export-import transactions. Specialized documents work correctly.

- VAT restoration.

- Reinstatement of VAT on real estate.

- VAT accrual for construction and installation work (economic method).

- Confirmation of zero VAT rate.

- VAT distribution of indirect expenses.

- Registration of VAT payment to the budget.

- VAT write-off.

Regular VAT accounting involves the creation and posting of regulatory documents “Creating purchase ledger entries” and “Creating sales ledger entries” at the end of each reporting period.

If the organization does not have tax features, then the difference between regular and simplified VAT accounting is only the need to quarterly create regulatory documents “Creating purchase ledger entries” and “Creating sales ledger entries.”

Attention. Simplified VAT accounting can be a piece of cheese in a mousetrap. It's better not to use it anyway.

Not much work! But, if you suddenly need to reflect something special, for example, accounting for VAT during construction and installation work, then in such situations you can use the appropriate configuration documents.

Attention. Setting the “Simplified VAT accounting” flag does not block special documents for regular VAT accounting. Therefore, if the “Simplified VAT accounting” flag is set, then do not use these documents. Most likely, the result will not be correct.

Full VAT accounting.

Full VAT accounting includes regular VAT accounting plus transactions for the sale of goods (products, works, services) that are not subject to VAT or taxed at a rate of 0%. To enable full VAT accounting, you must complete the following steps.

- Uncheck the “Simplified VAT accounting” flag.

- Set the flag “The organization carries out sales without VAT or with 0% VAT.”

In other words, full VAT accounting involves accounting for transactions at all three VAT rates established by law: at a rate of 0%, 10% and 18% and Without VAT,

It was noted above that with simplified VAT accounting, accounting for sales transactions without VAT or with 0% VAT is impossible. This is explained by the fact that setting the flag “The organization carries out sales without VAT or with 0% VAT” activates the VAT batch accounting mechanism using the accumulation register “VAT on purchased values.” This register stores VAT information for each batch of goods purchased. Entries in it are automatically registered with the relevant documents.

With simplified VAT accounting, you can, of course, manually keep track of batches using the “Adjustment of register entries” document. But why artificially provoke a headache?

Attention. For income tax payers. If a currency agreement has been concluded for the export of goods and prepayment for shipment is provided, then in the accounting settings, on the “Income Tax” tab, be sure to activate the radio button “Receiving or issuing an advance payment.”

The flag “Calculate VAT on shipment without transfer of ownership.”

Sometimes the parties agree that ownership of the shipped goods will pass to the buyer upon the occurrence of an event specified in the contract. For example, receipt of payment to the supplier's bank account. This right is not clearly established in legislation.

In accordance with clause 1 of Article 39 of the Tax Code of the Russian Federation, goods (work, services) are recognized as sales after the transfer of ownership of them to the buyer.

Since, according to paragraph 1 of Art. 146 of the Tax Code, the object of taxation is sales, then until the ownership of the goods has transferred to the buyer, the supplier may not charge VAT for payment to the budget. This is on the one hand.

On the other hand, there is a letter from the Ministry of Finance of the Russian Federation dated September 8, 2010 No. 03-07-11/379. It substantiates another point of view based on paragraphs. 1 clause 1 of article 167 of the Tax Code of the Russian Federation. VAT should be charged in the tax period in which the equipment was shipped, regardless of the moment of transfer of ownership.

Attention. If you don’t have the strength and desire to argue with the tax office, check the “Calculate VAT on shipment without transfer of ownership” flag.

Changing the state of the flag “Calculate VAT on shipment without transfer of ownership” is available for any VAT accounting method.

Procedure for registering invoices for advance payments.

In the 1C Accounting 8 program there is processing “Registration of invoices for advance payments” received from customers. This allows you to avoid manual registration of “Invoice issued” documents for the advance received. Processing allows you to automatically generate “Invoice issued” documents for advances received.

In this section, the user must secure the procedure for registering invoices issued for advance payments received by processing “Registration of invoices for advance payments”.

The “Registration of advance invoices” processing creates invoices for advances received for the period specified in it, taking into account the order specified in the accounting policy.

Always register invoices upon receipt of an advance.

Processing creates a SF for all received advances, with the exception of those advances that were repaid on the day the advance was received. That is, if the shipment took place on the day the advance was received, then the SF is not created for such an advance.

Do not register invoices for advances offset within 5 calendar days.

Processing creates a tax return only for those advances received for which there were no shipments within 5 calendar days after their receipt. This procedure complies with the requirement of clause 3 of Art. 168 of the Tax Code of the Russian Federation and the explanation given in the letter of the Ministry of Finance of the Russian Federation dated March 6, 2009 No. 03-07-15/39. That is, if the shipment was made in the first 5 days, starting from the date of receipt of the advance payment, then SF are not created for such advances.

According to clause 3 of Art. 168 of the Tax Code of the Russian Federation, upon receipt of an advance payment (full or partial) for upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), the corresponding SFs are issued no later than five calendar days, counting from the date of receipt of the specified amounts of payment (partial payment).

At the same time, the letter of the Ministry of Finance of the Russian Federation dated March 6, 2009 No. 03-07-15/39 provides the following explanation. If, within 5 calendar days, counting from the date of receipt of the advance payment, goods are shipped against this advance payment (performance of work, provision of services, transfer of property rights), then invoices for the advances received should not be issued to the buyer.

Do not register invoices for advances cleared before the end of the month.

Processing creates an invoice only for those advances received for which there were no shipments during the month in which they were received. This procedure corresponds to the explanation set out in the letter of the Ministry of Finance of the Russian Federation dated March 6, 2009 No. 03-07-15/39.

It concerns contracts providing for continuous long-term supplies of goods (provision of services) to the same buyer. For example, the supply of electricity, oil, gas, provision of communication services, etc.

When receiving an advance payment under such contracts, you can draw up and issue invoices to buyers for the advances received at least once a month and no later than the 5th day of the month following the expired month.

Do not register invoices for advances offset until the end of the tax period.

Processing creates an invoice only for those advances received for which there were no shipments during the quarter in which they were received. This procedure is not explicitly enshrined in legislation. It is designed for those taxpayers who are ready to defend their case in tax inspectorates or in the courts.

In Art. 163 of the Tax Code of the Russian Federation establishes the duration of the tax period as one quarter. From this, some experts come to the conclusion that prepayments that were repaid in the quarter they were received cannot be considered as advances. Therefore, there is no need to issue invoices for them. This opinion has been confirmed by a number of court cases.

Do not register invoices for advances (Clause 13, Article 167 of the Tax Code of the Russian Federation).

Processing does not create a SF for advances received. This procedure complies with the requirement of clause 13 of Article 167 of the Tax Code of the Russian Federation.

This procedure applies only to the list of goods (work, services) approved by the Decree of the Government of the Russian Federation of July 28, 2006 N 468 “On approval of lists of goods (work, services), the duration of the production cycle of production (execution, provision) of which is more than 6 months "

If the supplier organization receives an advance payment for goods (work, services), the production period of which exceeds 6 months (according to the list of the Resolution), then it has the right not to issue SF for an advance payment. For such situations, the tax base can be determined on the date of shipment of goods (work, services). An organization has the right not to issue SF for advances received only in the case of separate accounting of long-term and regular cycle production operations.

The procedure established in the accounting policy for the formation of SF for advances received applies to all customers. If a different procedure needs to be established with a specific buyer, then it can be established in an agreement with him.

Flag “Invoices for settlements in monetary units” form in rubles."

Russian organizations have the right to enter into agreements with each other in conventional units (cu). In such agreements, the “Settlement currency” detail specifies foreign currency or cu. and the “Calculations in conventional units” flag must be set. The same currency is indicated in payment documents. But payment under the contract is made in the equivalent amount in rubles. For brevity, such contracts are called contracts in conventional units.

It is believed that total indicators in printed forms of invoices for contracts in conventional units can be expressed in conventional units or in Russian rubles. When choosing this solution, it is advisable to take into account the position of the Federal Tax Service of the Russian Federation, set out in letter No. 3-1-07/674 dated August 24, 2009.

Attention. According to the Federal Tax Service of the Russian Federation, invoices must be printed in rubles.

The flag “Take into account positive amount differences when calculating VAT.”

The state of this flag is significant only for transactions under contracts in conventional units.

For contracts concluded in conventional units, a typical situation is when the date of payment and the date of sale (receipt) do not coincide. In this case, exchange rate differences arise in accounting, and amount differences arise in tax accounting.

If positive amount differences occurred before September 30, 2011, it was necessary to issue invoices for the amount of these differences. After setting the flag “Take into account positive amount differences when calculating VAT”, the user had the opportunity to automate this process using the “Registration of invoices for amount differences” processing.

On October 1, 2011, clause 4 of Article 153 of the Tax Code of the Russian Federation, introduced by Federal Law No. 245-FZ of July 19, 2011, came into force. Now, in case of amount differences, the VAT tax base is not adjusted. At the same time, positive (negative) amount differences arising from the supplier are taken into account as part of non-operating income (expenses), Art. 250 and 265 of the Tax Code of the Russian Federation, respectively.

For contracts in conventional units that began on October 1, 2011 or later, the “Take into account positive amount differences when calculating VAT” flag should be cleared.

The flag “Calculate VAT on the transfer of real estate without transfer of ownership.”

In the article by S.A. Kharitonov provides a detailed analysis of the order of the Ministry of Finance of Russia dated December 24, 2010 No. 186, which introduced changes to the accounting of real estate starting from January 1, 2011.

According to paragraph 3 of Art. 167 of the Tax Code of the Russian Federation, in cases where the goods are not shipped or transported, but the transfer of ownership of this product occurs, such transfer of ownership is equivalent to its shipment. Since the real estate is not shipped or transported, the buyer’s ownership of it arises at the time of state registration, and not on the date of the acceptance certificate.

It follows that before the fact of state registration there is no object of taxation and there is no need to charge VAT. This conclusion is also consistent with the explanations, for example, of the letter of the Ministry of Finance of Russia dated May 11, 2006 No. 03-04-11/88. Taking this into account, the flag “Calculate VAT on the transfer of real estate without transfer of ownership” should be removed.

However, arbitration practice sometimes indicates a different position of tax inspectorates. For example, the FAS VSO Resolution No. A19-12414/09 dated 02/11/2010 states that VAT must be charged on the day of the actual transfer of real estate to the buyer. If your tax office takes the same position, then you should check the box “Calculate VAT on the transfer of real estate without transfer of ownership.”

1.11. Tab “Without VAT and 0%”

The “Without VAT and 0%” tab is displayed if the “The organization carries out sales without VAT or with 0% VAT” flag is set on the “VAT” tab.

This flag is set in cases where an organization is engaged in the sale of goods for export (clause 1, clause 1,164 of the Tax Code of the Russian Federation) and/or provides services for the international transportation of goods (clause 2.1, clause 1, 164 of the Tax Code of the Russian Federation).

VAT for payment to the budget.

To confirm the right to apply the zero rate in accordance with clause 9 of Art. 165 of the Tax Code of the Russian Federation allots 180 calendar days from the date of placing goods under customs export procedures. If the supporting documents were not submitted to the tax authority within the specified period, then the organization is obliged to charge VAT for payment to the budget. To do this, you need to create a document “Confirmation of zero VAT rate” with the event “0% rate not confirmed”. The method of calculating the amount of VAT payable to the budget is determined by the accounting policy.

- VAT is deducted from revenue.

- VAT is charged on top.

0% ≠ Without VAT!

In Art. 149 of the Tax Code of the Russian Federation contains a closed list of transactions that are exempt from taxation. For them, the program has introduced the designation “Without VAT”. The rate “Without VAT” is an unconditional exemption from taxation. A rate without VAT is not equivalent to a rate of 0%!

The 0% rate is a benefit that a taxpayer can receive only if he documents the fact of export of goods. Or in other words, it will confirm its right to apply the zero VAT rate.

Let's return to the “Excluding VAT” rate. In the case of the acquisition of inventory items that are subject to VAT, but which the organization intends to use in transactions not subject to VAT, that is, at the “Without VAT” rate, the program offers you to select one of the options for reflecting input VAT in accounting.

- Include in the cost or write off as expenses in accordance with Art. 170 NNK of the Russian Federation.

- Always include in price.

- Always write off as expenses.

1.12. “Personal Income Tax” tab

The presence of the “personal income tax” tab is a consequence of the inconsistent opinion of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation.

The user is forced to independently choose the method of accounting for personal income tax deductions that is suitable for him.

- Cumulatively during the tax period. This is the position of the Federal Tax Service of the Russian Federation. Letter No. 04-2-02/35 of the Federal Tax Service of the Russian Federation dated February 11, 2005 states that “... a standard tax deduction is provided to an individual in the appropriate amounts for each month of the tax period during which an employment contract is concluded between the tax agent and the employee or contract of a civil law nature.”

- Within the taxpayer's monthly income. This is the position of the Ministry of Finance of the Russian Federation. The letter of the Ministry of Finance of the Russian Federation dated October 7, 2004 No. 03-05-04/41 states that “... standard tax deductions do not accumulate during the tax period and are not subject to cumulative summation in the absence of a tax base for individual months of the tax period.”

Simultaneously with the letter of the Federal Tax Service of the Russian Federation dated February 11, 2005 No. 04-2-02/35, the letter of the Federal Tax Service of the Russian Federation dated November 23, 2004 No. 04-2-06/679, which contradicts it, is also in effect. In it, the Federal Tax Service of the Russian Federation recommends adhering to the recommendations of the letter of the Ministry of Finance of the Russian Federation dated October 7, 2004 No. 03-05-04/41.

If necessary, the method of accounting for personal income tax can be changed in the current tax period. In this case, when calculating personal income tax for the next month of the current tax period, the amounts of deductions provided, as well as the personal income tax amounts for previous months, will be recalculated.

1.13. Tab “Insurance premiums”

Paragraph 1 of Article 57 of the Federal Law of July 24, 2009 No. 212-FZ establishes uniform insurance premium rates. However, for some insurance premium payers, the same law establishes reduced rates. The tariff used in the organization must be indicated on the “Insurance premiums” tab.

In the 1C Accounting 8 program, insurance premium rates for different categories of payers are stored in the periodic information register of the same name “Insurance Premium Rates”.

To be continued.

Form 2-NDFL certificate is used to confirm income to the tax office, to the bank to obtain a loan, and they are also issued to a resigning employee for presentation to a new place of work. Based on the 1C “Salary and Personnel Management” and 1C “Accounting 8.2 (8.3)” programs, this form has the form of a document that can then be printed. Let's take a closer look at generating help using the example of these two programs.

VAT accounting in 1C 8.3 Accounting 3.0. Accounting methods

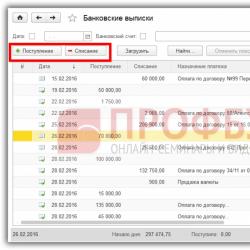

In the 1C 8.3 Accounting program edition 3.0 and later versions, there is an accounting register added to the configuration “Separate VAT accounting” for the 19th account.Balance sheet in 1C Accounting 8.3 (3.0)

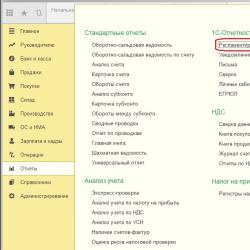

The balance sheet is an important document for submission to regulatory authorities. Using the example of the 1C Accounting 8.3 edition 3.0 program, let’s look at how the balance sheet is formed. To do this, go to the “Reports” menu tab in the “Regulated reports” section.Entering a new organization in 1C 8.3 and setting up accounting policies

Every 1C user, be it an accountant, manager or warehouse employee, is faced with the transition to an updated version of the program. Often, not only the interface changes in the program, but also the location of the logs, and some functions are added or removed. We invite you to consider how the initial entry of an organization and setting up accounting policies in the 1C Accounting 8 edition 3.0 program occurs.Control of negative balances in 1C 8.3 Accounting 3.0

Each organization controls the remaining goods in the warehouse. Sometimes situations arise that the product is actually in stock, but is not listed in the program balances. This happens very often in retail stores. There are two options: either sell the goods, or withdraw them from sale until the circumstances are clarified. The decision is based on the organization's internal policy regarding the accounting of balances.

Filling out nomenclature in 1C 8.3

Getting started with the 1C program involves entering basic data for further use, such as: filling out items, distribution into groups, setting up accounting accounts. We offer you step-by-step material for the initial filling in 1C Accounting edition 8.3.Filling out counterparty data in 1C 8.3

Who are the Counterparties? These are legal entities or individuals who are your customers, buyers or partners. Each legal entity has details, i.e. unique data (TIN, KPP, legal and actual addresses) that belong only to this organization. This is the data you will need to fill out the counterparty card in the program.Getting started and filling out directories in 1C: Trade Management 11.3

1C: Trade Management 11.3 offers a modern interface with flexible settings and a large number of tools for trading organizations. Compared to earlier versions, many things are implemented here that previously had to be completed independently. So, for example, in UT 11.3 it is possible to work with discounts and bonuses (including cumulative ones), solutions for monitoring and managing warehouse balances, purchases and many other functions have been thought out. The program provides everything to solve most enterprise problems through built-in components. Let's look at how to start working with 1C this version, if you already have a ready-made database, or you decide to create a new one. The principle of operation for the stationary version and the rented 1C online is the same.Entering initial balances in 1C 8.3 and 8.2

When an operating organization that does not have an existing database switches to accounting in the 1C program, it becomes necessary to enter initial balances for the accounting accounts used. This functionality is provided in the program and allows you to fill in the initial values of positions and their balances.Beginning of work. Setting up accounting policies in 1C Accounting 8.3

Before you start working in the program, you need to set up your organization's accounting policy. We are talking about such settings as 1c 8.3 and 8.2, such as: what taxation regime is the enterprise in, how to allocate costs, how to take into account production costs, depreciation methods, etc.

The question immediately arises - where can I find the accounting policy in 1C 8.3? The link to it is in the “Organizations” directory in the “Go” section:

The settings window for filling out the accounting policy consists of several tabs and two buttons for selecting a taxation mode. Let's look at all the bookmarks in turn associated with the general mode.

Income tax

The first tab to fill out is Income Tax.

The first element on this tab is a checkbox where you need to indicate whether accounting is applied according to the requirements of PBU 18.02. This is necessary for income tax to be calculated.

The following is the depreciation method. For intangible assets, structures and buildings, the linear accrual method is always used, regardless of which one was chosen. In other cases, a nonlinear method can be used.

There is no need to indicate anything in the “Repay the cost of workwear and special equipment” field, since at the time of writing this field is not available for editing, although the tooltip says that since 2015, the organization has the right to decide for itself how to write off the cost of workwear and special equipment.

The list of direct expenses and how to take them into account must be filled out either manually, or you agree with the system’s offer to fill out this list automatically. This is necessary when an organization conducts production activities and wants to attribute direct costs to the cost of production. When filling automatically, it is advisable to also fill in the “Division” and “Cost Item” columns.

Nomenclature groups are filled in for subsequent analysis of income from sales of goods and services, and they are also shown in the profit declaration. By default, there is already a “Main item group” entry there.

Let's move on to the next bookmark.

VAT

Here are the VAT accounting settings in 1C Accounting.

There are basically checkboxes here, in order:

- We indicate whether the company operates without VAT or with VAT at a zero rate. If this box is checked, when selling such goods or services, separate accounting will be carried out by batch in order to correctly reflect VAT

- If the organization uses simplified VAT accounting, check the appropriate box. Please note that simplified accounting has some limitations. For example, VAT cannot be charged on positive amount differences

- In the third paragraph you need to indicate whether VAT should be charged on the shipment if there is no transfer of ownership

- Here we indicate whether to charge VAT on the transfer of real estate without transfer of ownership

- Until 01.10.2011 For positive amount differences, VAT can be charged and separate invoices can be issued. If such accounting is required, check the appropriate box

- Invoices can be generated in conventional units. If this checkbox is checked, such invoices will be printed in rubles

You also need to choose how advance invoices will be generated.

UTII

If the organization is a UTII payer, check the appropriate box and select the cost distribution base.

Reserves

On this tab, you only need to select the method for valuing inventories.

Expenses

Here you need to indicate the types of activities for which costs are taken into account in account 20. You also need to indicate how indirect costs are included in the cost price and specify additional settings (if necessary).

Reserves

This tab indicates whether reserves will be formed in accounting or tax accounting, or in both at once.

Based on materials from: programmist1s.ru

To enter the parameters of the organization's accounting policy, you need to execute the command in the main menu of the program Enterprise->Accounting policy->Accounting policy of organizations.

To add an accounting policy entry, you need to click a button or key Insert or execute the menu command Actions->Add.

In the window you need to fill in the accounting policy parameters according to the example:

Setting up parameters for analytical accounting of inventories

To start working, the program needs to configure the parameters of analytical accounting of inventories (MPI). To do this, you need to execute the command in the main menu of the program Enterprise->Setting parameters accounting.

In the shape of Setting up accounting parameters need to switch to on d ku and check the boxes Keep warehouse records for accounting and tax accounting.

To set analytical accounting parameters and close the form Settings accounting, you need to press the button OK.

Open the chart of accounts, you need to execute the command in the main menu of the program Enterprise->Chart of accounts->Chart of accounts.

Width="623" height="194">

On the command panel of the chart of accounts form there are buttons that can be used to obtain additional information on the selected account:

Generate various standard reports, for example "Account balance sheet" or "Account card" - button Reports;

Read the description of the accounting account - button Description accounts;

View entries in the posting journal - button Magazine postings;

Go to subconto list - button Subconto.

Using a button Seal you can display and print the chart of accounts of accounting "1C: Accounting 8" both in the form of a simple list of accounts, and in the form of a list with a detailed description of each account.

Chart of accounts for tax accounting

The chart of accounts for tax accounting (for income tax) is not provided for by regulatory documents and is part of the accounting methodology in 1C: Accounting 8. It is intended to ensure that business transactions are reflected in tax accounting in accordance with the law “On the collection of taxes from enterprise profits.”

Open the tax accounting chart of accounts, you need to execute the command in the main menu of the program Enterprise->Chart of accounts->Chart of accounts for tax accounting (for income tax).

On the command panel of the tax accounting chart of accounts form there are buttons that can be used to obtain the following additional information on the selected account:

Generate various standard reports, for example “Account balance sheet (tax accounting)” or “Account card (tax accounting)” - button Reports;