Upp usn. Correct reflection of expenses in kudir. Section "Retail sales"

For 1C UPP and KA 1.1, it is very important that the accounting policy is set up not only for accounting and tax, but also for management accounting. Management accounting policies are configured for the entire program as a whole, and regulated accounting policies are filled out for each organization separately.

We will go in the order prescribed by the developer and start with management accounting policies.

Accounting policies in 1C UPP and Complex 1.1. filled out in the Accounting Manager interface. Menu: Accounting setup - Accounting policy

Accounting policy for management accounting in 1C UPP and Comprehensive 1.1

In the new database, management accounting policies are already configured by default. We review it and, if necessary, adjust it as needed for our company.

1. Inventories

This is what the default inventory setting looks like:

Here you can:

Change the strategy for assessing the cost of inventory upon disposal

Often it is enough for accountants to estimate the disposal of inventories “at the average”, but for management reporting they want to receive more detailed and accurate information. In 1C you can afford this - for this purpose, in the accounting policy of management accounting they set FIFO, and in the accounting policy - according to the average and obtain independent data on the cost of writing off inventories.

Do not include VAT in the cost of shipments

In accounting, VAT is always excluded from the cost of inventories in a warehouse, but in management accounting, you can choose the option that is familiar to you. Although the classical management accounting methodology requires the exclusion of VAT from the valuation of inventories, in Russia we often prefer to evaluate inventories on the “cash basis”, that is, by the amount of money paid. Then don't check the box.

If you gravitate towards the classical school, then check the box.

The setting concerns both VAT amounts upon receipt and customs VAT.

Keep records of organizations' inventories by warehouse.

This is one of the 1C settings that cannot be called intuitive.

1C has several registers that store information about the company’s products. The main registers - on which 1C relies when determining balances - are Goods in warehouses and Goods in organizations. They correspond to the reports: Goods in warehouses and Statement of goods and customs declaration of organizations.

Goods in warehouses, as the name suggests, always take into account balances by warehouse. But they have no organizations. To determine the balance exactly in the organization we need, we use the accumulation register “Organizational Goods”. This register stores information about goods by organization. Here, warehouse analytics is configured using the accounting policy parameter.

In some cases, it is convenient not to take into account the warehouse for organizational goods. For example, the division of warehouses in your company is conditional. Then you can allow users with additional rights to sell goods without controlling stock balances in warehouses, but leave control over the balances of organizations. Then the manager will be able to sell the product from any warehouse, as long as it is listed in the organization on whose behalf he is selling. In this case, the movement of goods can be done after the fact. So as to level out negative warehouse balances.

The procedure for forming accounting prices.

In trading companies, as a rule, inventory records are kept at direct (actual) costs.

In accounting, it is configured independently.

2. Production and cost accounting

Here we configure the inclusion of VAT in production costs in management accounting. It is logical for this setting to coincide with your choice regarding the inclusion of VAT in the cost of shipments on the previous tab.

For 1C UPP, it is possible to enable the use of production orders in production accounting. In Integrated Automation, the use of production orders is not provided.

3. Cost sharing

Here you can only configure the general cost accounting option for management accounting. Either include them in the full cost of production or... not include them. There is no profit and loss statement in management accounting as such. Therefore, in the case of “direct costing” (the first option on the tab), nothing simply happens to these costs. True, such a report can still be customized within the budgeting subsystem, but that is a different story.

In accounting, it is configured independently.

4. Cost details

When writing off indirect production costs, you can take them into account in work in progress under the same cost item, or you can aggregate them. That is, for all costs of one type, determine a generalized item. For example, when distributed to work in progress, all general production items are collapsed into the item “Overhead production expenses”.

However, I haven’t seen generalized articles used here for a long time. We love details, and you can enlarge them in reports.

In accounting, it is configured independently.

5. Discounts

Here you configure the types of discounts available in sales documents. If the flag is not set, then a discount of this type cannot be set in the program. They will be visible in the discount setting document, but 1C will not allow you to save a document with this type of discount.

Setting up the use of discount cards is described in sufficient detail in the program’s context-sensitive help; I will not repeat it here.

6. Classification of buyers

It’s best not to set up customer classification right away. This information is based on data statistics from the system itself. Therefore, while there is little data, the classification itself contains little useful information. When several months have passed, you can see how the statistics behave depending on the settings and choose the most suitable option for your activity. The program has a classification of not only buyers, but also items. And it provides very useful sales information.

That's it, we have defeated management politics. Let's move on to accounting and tax accounting.

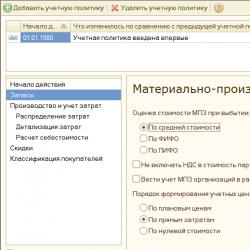

Accounting policy for accounting and tax accounting in 1C UPP and Comprehensive 1.1

It is necessary to set up accounting policies for accounting in 1C UPP and Comprehensive 1.1 for each organization and for each year in which there were at least some documents carried out in accounting and tax accounting. Including documents of initial balances.

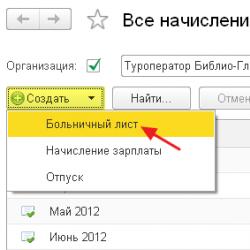

Click on the green plus sign to add a new one. And we start filling it out.

1. General

We choose a taxation system and indicate whether we use UTII.

Simplified tax system - if we select the simplified tax system, then some of the bookmarks disappear, but the simplified tax system bookmark appears.

If you specify the option Income minus expenses on this tab, an additional tab Expenses of the simplified tax system will appear, on which you can further configure events for recognition of expenses of the simplified tax system.

UTII - adds a UTII tab where you can specify the base and adjust UTII accounting accounts.

The last flag is production activity. It must be installed if your organization produces products or provides services for which you would like to calculate the cost. The checkbox controls the availability of production settings and the ability to maintain production records in the program.

If you only have trading activities, then it is better to uncheck this box, this will simplify the program settings.

2. Settlements with counterparties

The first switch configures the moment of crediting advances. When posting an invoice, the system can find advances under the contract and immediately make postings to close the advance.

Another option: when posting documents, the advance is not offset; special processing is launched to automatically close advances. This option is more often used when documents are entered out of order and at the time of posting the document it is impossible to determine whether the advance amount applies to it.

Setting up the calculation of reserves has detailed contextual descriptions, so I will not dwell on it here. Select the settings that suit your accounting policy.

3. Inventories

To the inventory accounting settings that we discussed in the accounting policy for management accounting, here we have added the ability to set up accounting for TRP (transportation and procurement costs). They can either be included in the cost of inventory on the same accounting account (first option) or accounted for in a separate account.

Please note that the second option is now only available if accounting parameters You have selected advanced cost analytics.

4. Production and cost accounting

For UPP, it is possible to configure cost accounting in regulated accounting for production orders. This is a very important setting, as it allows, when using production orders, to keep track of cost and work in progress in the context of production orders. That is, for example, for production for a specific order, only the costs that were allocated to this order will be written off. Costs for another order will remain in work in progress, even if they belong to the same item group.

If you keep track of manufactured products at planned prices, then you can also configure the use of 40 accounts here.

5. Cost sharing

The bookmark is only available in 1C UPP. But even there it makes sense to skip it for now. Filling out cost distribution methods on this tab is frankly inconvenient. They can be configured in a separate reference book or as the cost items themselves are created.

6. Cost details

We have already discussed the first block in the same paragraph of management accounting policy. But the second one is very interesting. What happens if you leave the default setting - write off transactions collectively?

For allocated items, expenses will be charged to the expense account, but will not be written off against this item. On the other hand, amounts without an expense item will be written off. In general, everything on the account will be closed. But! When generating a balance sheet for cost items for any cost account, we will receive accumulating balances for cost items and red minuses for an empty item. This will make the back unreadable and unsuitable for checking the correctness of the write-off. In general, in my opinion, it is better to put “in detail”.

7. General expenses

In accounting, there are two options for distributing general business expenses.

OCR is included in the cost of production - if you choose this option, you will also need to set up distribution methods for cost items with a “general business” nature.

OHR are written off using the direct costing method. If you choose this option, you must choose to set up the account to which the costs will be charged. Usually it is 90.08. And you need to select a base for distribution into item groups.

8. Income tax

In 1C UPP and Comprehensive 1.1, tax accounting is maintained independently of accounting on a separate chart of accounts.

Naturally, there is no need to enter tax accounts into documents separately. Compliance is configured for accounting and tax accounts. Moreover, by clicking on the “Set correspondence between accounting and financial statements” button, we will find that this correspondence is already set by default. If you want to change some settings or add invoices, you can make changes directly to an existing document.

And lastly: establish the use of PBU 18/2 for calculating temporary and permanent differences.

9. Working clothes and special equipment

Here you can define the method of repayment of the value for tax accounting. The first option is clear - we always repay immediately, upon commissioning.

In accounting, it is possible to configure the repayment method for each item separately. This can be configured directly in the item reference book. That is, the second method is to automatically do it in tax accounting in the same way as it will be configured in accounting.

10. VAT

Regarding VAT settings, difficulties can arise only when setting up accounting at rates without VAT and 0% if you have sales at these rates.

When setting the flag, you need to pay attention to the setting that becomes available:

Maintain batch accounting of VAT in the context of series and characteristics.

The fact is that when accounting for VAT rates is enabled, batch accounting for VAT distribution is carried out independently. If you will keep batch records by batch or use characteristics, this attribute should be set. Otherwise, situations will most likely arise when, due to differences in the order of write-offs, the write-off amounts and party documents for VAT accounting and in accounting will differ. This may create difficulties for you when selecting documents to confirm with the tax office.

Webinar recordings

The article is a list of operations that are performed in the program during commission trading. An explanation is provided for each transaction in order to correctly reflect the transaction in KUDiR. The material, in terms of presentation language, is intended more for programmers.

First of all, I note that to generate records in KUDiR When posting documents, it is necessary to set the reflection flag in the NU in the document form.

So, the organization sells the goods of the Principal to the Buyer.

1.1. Receipt of goods from the Principal to the Organization. Document: "Receipt of goods and services."

- Postings: 004.01 /

(Note . If the general taxation system is used when posting a document, then the receipt will be made according to the “Consignment of Goods NU” register, with accounting account 004.01 from the tax chart of accounts; if the simplified tax system is used, then the accounting account is recorded from the accounting chart of accounts. If sales and receipts are carried out under different taxation systems, then the problem of writing off batches for tax accounting arises.)

1.2. Payment to the Principal for unsold goods. Documents: “RKO”, “Outgoing payment order”.

- Postings: 76.09 (advance account) / 51 (50)

1.3. Sale of consignment goods to the Buyer on an advance payment basis, when the receipt of funds from the Buyer is issued before the shipment document.

1.3.1. Payment from the Buyer for the goods. Documents: “PKO”, “Incoming payment order”.

- Postings: 51 (50) / 62.02

1.3.2. Shipment of goods to the Buyer. Document "Sales of goods and services". If the contract with the buyer is carried out in the context of settlement documents (there is a corresponding checkmark in the contract), then in the sales document on the “Prepayment” tab it is necessary to indicate the relevant payment documents.

- Postings: / 004.01; 62.01 / 76.09; 62.02 / 62.01

- In section 1 of the Income and Expense Book, an entry is made in column 5 for the amount of shipment with a negative sign.

1.4. Sale of consignment goods to the Buyer when the document for receipt of funds from the Buyer is issued later than the shipment document.

1.4.1. Shipment of goods to the Buyer. Document "Sales of goods and services".

- Postings: / 004.01; 62.01 / 76.09

- According to the register "Mutual settlements of the simplified tax system": receipts under the agreement with the Buyer for the amount of shipment and expenses under the agreement with the Principal for the amount of shipment

1.4.2. Payment from the Buyer for the goods. Documents: “PKO”, “Incoming payment order”. If the contract with the buyer is carried out in the context of settlement documents (there is a corresponding checkmark in the contract), then in the payment document it is necessary to indicate the settlement documents - the corresponding invoices.

- Postings: 51 (50) / 62.01

- According to the register "Mutual settlements of the simplified tax system": expenses under the agreement with the Buyer for the amount of payment.

- In section 1 of the Income and Expense Book, an entry is made in column 4 for the amount of payment.

1.5. Preparation of a sales report to the consignor. Document "Report to the consignor on sales of goods." If at the time of the report the goods sold were paid for by the Buyer, then on the “Cash” tab you need to indicate the amount and type of payment. If at the time of the report the goods sold were paid to the Principal, then on the “Prepayment” tab you need to indicate the documents and payment amounts.

- Postings: 76.09 / 90 (Income account)

1.6. Payment to the Principal for goods sold, if there was no payment before. Prepared by entering documents:

"RKO", "Payment order outgoing" from the document "Report to the principal on sales of goods".

In this case, in order to reflect the remuneration for the sale of goods in column 5 of the book of income and expenses, it is necessary to check the “Withhold commission” checkbox in the document “Report to the principal on sales of goods”. The payment amount in payment documents is filled in automatically and is equal to the cost of the goods sold minus the remuneration amount.

1.6.1. In the document "Report to the consignor on sales of goods":

- Postings: 76.09 / 90 (Income account)

- According to the register "Mutual settlements of the simplified tax system": receipt under the agreement with the Principal for the amount of remuneration.

- In section 1 of the Income and Expense Book, an entry is made in column 5 for the amount of remuneration.

1.6.2. In the payment document:

- Postings: 76.09 / 51 (50)

- According to the register "Mutual settlements of the simplified tax system": receipt under the agreement with the Principal for the amount of payment.

- In section 1 of the Income and Expense Book, an entry is made in column 6 for the amount of payment.

1.7. Receipt of payment-remuneration from the Principal for the sale of goods, if the Principal was previously paid the entire cost of the goods, excluding remuneration. If the agreement with the Principal is carried out in the context of settlement documents (there is a corresponding checkmark in the agreement), then in the payment document it is necessary to indicate the settlement document - “Report to the Principal on sales of goods”, since It is this document that accrues remuneration for the sale.

Documents: “PKO”, “Incoming payment order”.

- Postings: 51 (50) / 76.09

- According to the register "Mutual settlements of the simplified tax system": expenses under the agreement with the Principal for the amount of payment.

- In section 1 of the Income and Expense Book, an entry is made in columns 4 and 5 for the amount of payment.

1C UPP provides flexible settings for parameters of any type of accounting, with which you can fully configure the accounting rules in accordance with which the organization operates.

In order to take into account all the nuances, we recommend that at the stage of the pre-project survey, the accounting parameters are fully specified and agreed upon with key users. Firstly, this can serve as a solid basis for building a truly effective system (since regulated accounting has strict rules, and management reflects the real state of affairs in the enterprise), and secondly, it will avoid problems with implementation and discrepancies in data between the old and a new accounting system.

In this article we will take a detailed look at setting up the parameters of regulated types of accounting – accounting and tax.

Access to setting up accounting parameters

Let’s log in with administrator rights and switch to the “Accounting and Tax Accounting” interface.

Figure 1. Working in the interface with administrator rights

After changing the interface, an additional section “Accounting Settings” will appear in the top menu, in which you need to select the “Accounting Parameters Settings” item.

Figure 2. Settings tab

A window will open in which all parameters available for configuration are logically grouped into sections. Let's take a closer look at the parameters and settings for each section.

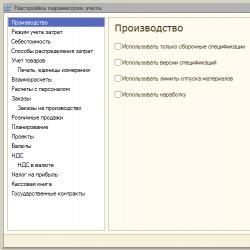

Section "Production"

In the “Production” section, the rules for drawing up production documents are indicated:

- Use assembly specifications only– by activating the parameter, users will be able to set the view to “Assembly”. A disabled flag makes additional specification types available – “Full”, “Node”. If you do not plan to use them, it is better to set the flag to avoid user errors in document preparation.

- Specification versions– if the flag is enabled, users will be able to specify different versions in the item specification; if disabled, then each specification can have only one version.

- Use material issue limits– when the flag is turned on, the ability to work with the functionality of limit-fence cards is activated. It is better to uncheck the flag so as not to overload the configuration with redundant, unnecessary functionality when this is not practiced at the enterprise.

- Use operating time– when the flag is turned on, the ability to set the output type “Working hours” in the “Production report for a shift” is activated. If this is not practiced at the enterprise, it is better to remove the flag so as not to overload the configuration with redundant, unnecessary functionality.

Figure 3. Settings for accounting parameters “Production”

Figure 3. Settings for accounting parameters “Production”

Section "Cost Accounting Mode"

The 1C UPP system provides modes "Advanced Analytics", or "Part accounting"*.

The first of them is better suited for production, because allows you to take into account all production costs and inventories on all accounting accounts separately for regulatory and management accounts. At the same time, users have the opportunity to receive detailed analytics on the movement of items and costs. When selecting this mode, the chronological order of document entry is not taken into account.

The second is more suitable for trading companies, for which it is important to accurately determine the cost of a specific batch and see the gross profit from sales in real time.

Figure 4. Cost accounting mode settings

Figure 4. Cost accounting mode settings

*Setting the modes is described at the top level, since this is a separate, large topic. For example, in RAUZ you can configure the detailing, and in batch - the order of write-off.

Section "Cost"

This indicates the type of prices at which the cost is taken into account. The information register “Item prices” must first be configured.

Next, check the boxes for management or regulatory accounting separately. It is used if different warehouses of the same company have different business conditions. In this case, total and batch accounting will be maintained for each warehouse separately. When the option is not activated, the calculation is made for the company as a whole, regardless of the specific warehouse.

Figure 5. Cost settings

Figure 5. Cost settings

Section "Methods of cost distribution"

These settings are used in the advanced cost accounting analytics mode.

If you still want to enable this setting, you should set the rules for calculating the base on the “Distribution Base” tab, within the framework of which the distribution base will be calculated, and you will also select a strategy for calculating the share of costs for each type of product depending on the volume of output, sales volume , occurrence of certain raw materials, according to standards, or manually.

You can distribute costs by type of production: for your own products, products of a third-party processor, products from customer-supplied raw materials, for operating time, for individual departments, for a percentage or for a coefficient.

Figure 6. Settings for cost distribution methods

Figure 6. Settings for cost distribution methods

Section "Goods Accounting"

- Activation of the first group adds the corresponding lines in documents and reference books for accounting according to specified characteristics, as well as for processing transactions with containers.

- The second group is responsible for the ability to work across several warehouses in the tabular part of the selected document.

Figure 7. “Goods Accounting” settings

Figure 7. “Goods Accounting” settings

Section “Printing, units of measurement”

This section is intended for customizing the appearance of printed forms of documents. It is possible to display an additional column with the desired parameter, for example, product code or article number, as well as specify the unit of weight and unit of volume for use in the product characteristics.

Figure 8. “Print, units of measurement”

Figure 8. “Print, units of measurement”

Section "Mutual settlements"

Here, uniform rules for debt control and banking documents are established:

- Way to control days in debt on calendar or weekdays.

- Posting a document based on registration time– the document will be posted at the same moment when confirmation of the transaction is received from the bank. Preferable when you need to track payments from customers in real time.

- At the end of the day of registration date In general, it reduces the system load; it can be used when it is not enough to receive payment reports promptly.

Figure 9. Settings for accounting parameters “Mutual settlements”

Figure 9. Settings for accounting parameters “Mutual settlements”

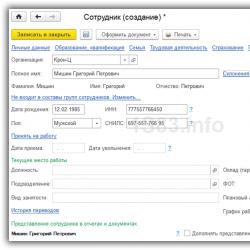

Section "Settlements with personnel"

The section is intended for setting up filling in the details “Employees” and “Type of wage accrual” in transactions. If you select the “For each employee” option, you will need to fill out these details for each employee. When you select the “Summary...” option, these details are not included in the transactions.

Figure 10. Personnel calculations

Figure 10. Personnel calculations

Section "Orders"

Here you can configure work with orders.

- Auto-reservation strategy specifies the procedure for reserving goods based on customer orders.

- Activation “Indicate orders in the table section” displays an additional column in the receipt and sales documents, which displays the order number.

- Use internal orders activates the functionality for creating internal orders as a separate document with an identical name. If the company does not use a system of such orders, it is better to disable the flag so as not to burden users with redundant information.

- Specify series when making a reservation of goods in warehouses allows you to take into account series (only subject to a reserve for orders indicating the counterparty agreement, which sets the attribute “Separate accounting of goods according to buyer orders”).

- Account for customer returns– when the flag is turned on, the weight of ordered goods changes automatically when posting “Return of goods from the buyer”.

Figure 11. “Orders” settings

Figure 11. “Orders” settings

Section "Orders for production"

The section is intended for setting parameters for working with production orders.

When the flag is enabled "Use production orders" The additional document “Production Order” becomes available.

Enabling the following flag makes it possible for each order to calculate the requirements for materials and semi-finished products for the production of finished goods.

Closing needs can be implemented in one of two modes:

- Obviously– using the document “Adjustment of production order”. They are also completely closed when conducting the “Production Report for the Shift”, “Item Assemblage” and “Act on the Provision of Production Services”, if all goods have been released according to the order.

- Automatic– that is, when dividing materials into the release of goods, as well as when registering it using “Item Assemblage”.

Figure 12. Production orders

Figure 12. Production orders

Section "Retail sales"

Designed to configure retail sales parameters:

- Possibility of payment by payment cards, bank loans;

- Accounting for the sale of alcoholic products;

- The procedure for sending electronic checks to the buyer.

Figure 13. Retail sales

Figure 13. Retail sales

Section "Planning"

The section is designed to configure planning parameters:

- Frequency of access to key resources specifies the time interval in which planning is carried out: day, week, decade, month, quarter, half-year, year.

- Perform shift planning– when activated in specifications and production orders, the shift planning mechanism becomes available.

Figure 14. Scheduling settings

Figure 14. Scheduling settings

Section "Projects"

Here you can configure accounting in the context of Projects.

- Keep records of projects– activates additional detail on projects for sales, purchases, cash flows, costs and planning.

- Use distribution types by project– when the flag is enabled, additional tools are activated for allocating basic costs to projects.

- Keep track of project costs– activates the posting of indirect costs across projects.

- Indicate projects in the tabular part of documents– in documents reflecting financial transactions, an additional column “Project” becomes available, in which you can indicate which specific projects the costs relate to.

Figure 15. “Projects” accounting parameters settings

Figure 15. “Projects” accounting parameters settings

Section "Currencies"

Here you can configure the currencies used for accounting*, management and IFRS accounting.

*Regulation currency is the base currency, its rate is always equal to 1 (for the Russian Federation - ruble).

Figure 16. “Currency” accounting parameters settings

Figure 16. “Currency” accounting parameters settings

Section "VAT"

The section is intended for setting up the numbering and printed forms of invoices. It is possible to indicate the full or full and abbreviated name of the seller, as well as set a separate numbering for invoices for advance payments.

Figure 17. Settings for VAT accounting

Figure 17. Settings for VAT accounting

Section “VAT in currency”

The section establishes the method for calculating the VAT amount for documents in foreign currency. When choosing the option “By the ruble amount of the document”, the VAT amount will be calculated by multiplying the ruble amount by the VAT rate.

When choosing the option “By currency amount of VAT”, the ruble amount of VAT is calculated by multiplying the currency amount of VAT by the document exchange rate.

Figure 18. Settings for accounting parameters “VAT in currency”

Figure 18. Settings for accounting parameters “VAT in currency”

Section "Income Tax"

The income tax is set up for property and services pre-paid under an agreement in foreign currency and the rules for supporting PBU 18/02 when taking into account amount differences when payment is received under agreements in cu. after transfer of ownership.

Figure 19. Settings for accounting parameters “Income tax”

Figure 19. Settings for accounting parameters “Income tax”

Section "Cash Book"

This section allows you to configure options for maintaining cash books: for separate divisions or for the organization as a whole.

When the flag “Use maintenance of cash books by separate divisions” is enabled, the subaccount type “Divisions” will be added to accounts 50.01 and 50.21; when the flag is removed, the subaccount type will be deleted and the process will be possible only for the entire organization as a whole.

Figure 20. “Cash Book” accounting parameters settings

Figure 20. “Cash Book” accounting parameters settings

Section "Government contracts"

The section is intended for setting up additional functionality for accounting for payments under government contracts.

When the flag is turned on, it becomes possible to work with objects of the “Government Contracts” subsystem. For a bank account, counterparty agreement and applications for spending funds, you can establish compliance with a government contract.

For Settings for uploading supporting documents the directory for uploading supporting documents when exchanging with the bank is indicated, as well as the maximum size of the supporting document file (MB) and the supporting document archive file (MB).

Figure 21. Accounting settings “Government contracts”

Figure 21. Accounting settings “Government contracts”

This completes the review of accounting parameters settings in the 1C UPP system. For more detailed information about the system capabilities and configuration rules, you can contact our consultants.

It happens that situations arise when, when entering all the documents, the expected expenses are not displayed in the book of expenses and income.

Let's consider the most common reasons why expenses reflected in accounting are not displayed in KUDIR.

1. Props “Expenses (OU)”

In accordance with Art. 346.16 of the Tax Code of the Russian Federation, the list of accepted expenses is closed, i.e. Only those expenses that are explicitly listed in this article can be taken into account as expenses.

When reflecting expenses in the program, it is indicated whether these expenses are accepted or not, that is, they comply with the requirements of Art. 346.16 of the Tax Code of the Russian Federation or not.

For example, in the document “Receipt of goods and services”, reflecting the services of a third-party organization, it will look like this.

Fig. 1 “Document – Receipt of goods and services”

It is worth noting that expenses are considered not accepted if the “Expenses (OU)” detail is not filled out.

When it comes to goods and materials, there are certain difficulties. For them, the acceptability of expenses is determined by both receipt and write-off.

For example, despite the fact that in the receipt document it is indicated “accepted” for materials and goods, expenses for them will not be accepted if, for example, the materials were written off as non-acceptable expenses, and the goods were sold as part of activities subject to UTII.

Another example is the free supply of materials. Such materials will not be accepted as expenses. Even if the requirement - invoice indicates “accepted”, in the receipt document in the column “Expenses (OU)” it will be indicated “not accepted”.

2. Payment and other necessary conditions

As required by the cash method, expenses will be recognized only after actual payment has been made.

For certain types of expenses there are additional conditions, for example, expenses for the purchase of goods cannot be accepted before they are sold.

The program automatically monitors all necessary conditions, and until all necessary events are reflected, the consumption will not be displayed in KUDIR. Therefore, the second reason may be the fact that the expenses were not paid or certain events that are necessary to recognize the expense did not occur.

3. Sequence of documents

One of the most common reasons is backdating of documents.

When working with documents backdated, it is necessary to repost all later documents associated with these expenses. If you cannot establish a connection, you will have to rewire everything.

4. Opening balances

In the simplified taxation system, special accounting is kept in special accrual registers. These registers contain information about consignments of goods and materials, mutual settlements, and specific information about expenses.

Initial balances must be entered into these registers, that is, if there are expenses that are associated with operations incurred before the start of accounting or before the transition to a simplified taxation system, then this information must be entered. If you do not enter initial balances, then expenses may not be included in KUDIR, here is another reason.

5. Accounting validity date

In “1C: Accounting 8” there is a mechanism that allows you to split document processing into two stages to speed up work - quick registration of the document and final posting in batch mode. In this mechanism, there is such a thing as the date of relevance of the accounting - before this date, the accounting is current and the documents have been completed in full, and after this date the documents still await final completion. In view of this, expenses may not be recognized if the document is not fully posted (located after the date of relevance).

6. Mutual settlements using settlement documents for tax accounting only

This situation is quite rare, but since it is difficult to identify it on your own, it deserves a separate description.

In 1C: Accounting 8, accounting for mutual settlements under an agreement with a counterparty can be maintained in two ways:

- According to the agreement as a whole;

- According to settlement documents.

If the contract of the counterparty establishes the conduct of mutual settlements according to settlement documents, then in order to offset the advance, you must explicitly indicate the payment document on which this advance was received, and when paying, explicitly indicate the document to be paid; if this is not done, then in accounting there will be no calculations according to the “settlement document” analytics with the counterparty” and the problem will immediately become noticeable.

Accounting for mutual settlements for the purposes of the simplified tax system works the same way. It is possible that in the accounting settings the maintenance of the “Settlement document with the counterparty” analytics is disabled, but agreements “based on settlement documents” are used. In this case, according to accounting, it is not noticeable that advances and payments are not closed, and in tax accounting, expenses are considered unpaid and are not reflected in KUDIR.

In such a situation, it is recommended to correctly fill in the “settlement document” details in the documents or refuse to use agreements with mutual settlements “according to

settlement documents" and use instead an agreement with mutual settlements under the "agreement as a whole".

Analysis of the state of expenses subject to reflection in tax accounting according to the simplified tax system

The accumulation register “Expenses under the simplified tax system” stores information about each expense of the organization, which can be reflected in the KUDIR.

The information of greatest interest is:

- for what reasons and what expenses are not accepted for tax accounting;

- What needs to be done to ensure that these expenses are accepted for tax accounting.

In order to be able to determine the current state, expenses are stored in the context of statuses, which determine what events must occur in order for an expense to be recognized as reducing the tax base. When an event occurs that is subject to tax accounting of expenses, a new status is established for the corresponding expense. An expense must pass all the corresponding statuses in order to be accepted for accounting.

Expense statuses can take the following values:

- Not written off;

- Not written off, not paid;

- Not paid;

- Not paid, not paid by the buyer;

- Not paid by buyer.

There is a report with which you can monitor the status of expenses in the “Expenses under the simplified tax system” register - this is a universal report “List\Cross table”.

For organizations that use the simplified taxation system (hereinafter referred to as the simplified taxation system), it is necessary to create a book of income and expenses (hereinafter referred to as KUDiR). To automatically generate KUDiR records in the 1C:Manufacturing Enterprise Management (1C:UPP) program, you first need to set up an accounting policy for accounting and tax accounting.

On the “General” tab, you must select the taxation system - Simplified. Next, go to the “STS” tab. Here you need to select the object of taxation: Income or Income minus expenses, indicate the date of transition to the simplified tax system, the number and date of the notification of the transition to the simplified tax system.

When you select the tax object “Income minus expenses”, the “STS Expenses” tab becomes available.

On this tab, the conditions for recognizing expenses are established, i.e. it is determined which events must occur for expenses to be recognized in order to be accepted for tax accounting.

To generate entries in the Income and Expense Book in 1C:UPP, the following registers are used:

The accumulation register “Mutual settlements of the simplified tax system” for monitoring mutual settlements with counterparties, accountable persons, and employees. Accounting is carried out with detail up to the settlement document.

Accumulation register “Expenses under the simplified tax system” for accounting expenses. Expenses are taken into account by type of expense (items, services, additional expenses, wages, taxes, etc.), expense elements (elements of the directory Nomenclature, Individuals, etc.), settlement documents, batches, payment statuses, reflection order in NU (Accepted, Not Accepted, Distributed), etc. Expenses are written off using the FIFO method.

Accumulation register "Book of income and expenses." This register stores KUDiR records, from which the Income and Expense Accounting Book is subsequently formed.

Create a Book of Income and Expenses you can generate the report “Income and Expense Accounting Book” (menu Reports-Accounting and Tax Accounting) (the report is generated according to the accumulation register data “Income and Expense Accounting Book”).

Also, to check the correctness of the formation of KUDiR, you can generate a report “Analysis of the state of tax accounting according to the simplified tax system” (the report is generated according to the data of the accumulation register “Book of records of income and expenses”).

In this report, all income and expenses are divided into sections. A transcript is available for each section. (the transcript is generated according to the accumulation register “Expenses under the simplified tax system.”)

Let's take a closer look at some of the sections.

Receipts from buyers.

This section contains data on receipts of funds from customers, for example, documents “Incoming payment order” with the transaction type “Payment from buyer” or “Cash outflow order”. A transcript of this section is presented below:

Products and materials.

This section includes data on expenses by type of accounting “Nomenclature”, for which the reflection in the NU upon receipt is set to “Accepted”.

For each item, you can also display a transcript in which receipts, payments, write-offs and recognition of expenses are reflected graphically and according to documents.

Let's look at how entries get into the Book of Income and Expenses by item. To do this, let’s take a closer look at the accounting policy settings:

By default, in order to be included in expenses for the purchase of goods and materials, there are 2 prerequisites:

1) Receipt of goods (materials) - documents “Receipt of goods and services”, “Advance report”.

2) Payment for goods (materials) to the supplier – “Outgoing payment order”, “Cash outgoing order”.

After these 2 conditions are met (the presence of both documents), expenses for the purchase of goods fall into the Income and Expense Accounting Book.

You can also select 2 additional conditions in your accounting policy:

For materials:

3) Transfer of materials to production - “Demand-invoice”. When this flag is set, expenses for the purchase of materials are considered recognized only after the “Requirement-invoice” document has been posted.

4) Product output – document “Production Report for a Shift”.

For goods:

3) Sales of goods – document “Sales of goods and services”.

4) Receiving income (payment from the buyer).

Third-party company services

This section contains information about services. To be accepted as an expense, 2 conditions must be met: reflection of the provision of the service (“Receipt of goods and services”) and payment to the supplier.

In this example, services were received in the amount of 200,000 rubles, but 150,000 rubles were paid to the supplier, therefore, expenses were recognized only in the amount of 150,000 rubles, and 50,000 rubles. remained unrecognized, therefore they will be included in expenses only after the next payment.

Additional costs for the acquisition of inventory items.

To reflect additional expenses in the Income and Expense Book, you must also consider the accounting policy settings:

Mandatory conditions for recognizing expenses are the receipt of additional expenses (the document “Receipt of additional expenses”) and payment to the supplier.

An additional condition is the write-off of inventories; in this case, additional expenses will appear in the Income and Expenses Accounting Book only after the write-off of inventories (goods or materials) to the cost of which the additional expenses were attributed.

Salary.

This section reflects labor costs. Explanation of this section allows you to see information by employee.

The report shows the initial balance, accruals (amount of accruals - personal income tax), payments, final balance, as well as the amount accepted for expenses.

To accept payroll costs as expenses, it is necessary to reflect the payroll (“Reflection of wages in registration accounting”), where in the Reflection in NU column “Accepted” will be selected, and the payment of wages must also be reflected (“Outgoing payment order” with the type of operation “Transfer of wages”, “Expense cash order” with the type of operation for payment of wages).

Taxes, contributions and personal income tax

This section reflects the costs of paying taxes and contributions.

To be accepted as an expense, it is also necessary to reflect the fact of tax accrual (“Reflection of wages in registered accounting” with the Reflection type in NU “Accepted”) and the payment of taxes (“Outgoing payment order” with the transaction type “Transfer of taxes”).

other expenses

This section includes all other types of expenses, for example, transactions entered in documents “Cash expenditure order” with the transaction type “Other cash expenditure”, “Payment order for debiting funds” to reflect bank service transactions and others.

It is worth noting that in cash flow documents (payment orders, cash orders), the KUDiR button is available for some types of transactions, which allows the user to manually determine the content of the transaction and the amount of income or expenses, incl. accepted.

Also, an entry in the Income and Expense Book can be entered manually using the document “Entry in the Income and Expense Book (Manual Account)”

When using the Advanced Cost Accounting Analytics mode to generate income and expense ledger entries, you must run the “Restore the sequence of the simplified taxation system” process. You must select an organization and set the update date, then click the “Run” button.

In conclusion, it is worth noting that for the correct formation of entries in the book of income and expenses, a necessary condition is the restored sequence of document processing, because Often documents are entered retroactively, so at the end of the period it is necessary to sequentially re-enter all documents.

Thank you!