How to reflect sick leave in 1s. Carrying out accrued sick leave

Registration of sick leave in 1C Accounting 8.3 (edition 3.0)

2016-12-07T18:15:57+00:00Finally, the troika has grown to the point where I confidently recommend that all accountants do accrual of temporary disability benefits (sick leave) not the old fashioned way (a separate type of accrual), but specially created for these purposes document "Sick leave".

This allows you to automate the calculation of average earnings for further vacations and sick leave, and also in some way brings 1C: Accounting 8.3 closer to 1C salary and personnel. But first things first.

Here, for now, there are only payroll accruals for past periods. Let's create a document "Sick leave":

Let's fill out the document in accordance with the figure below:

We filled in the month (sick leave is accrued in January), selected an employee, indicated the cause of incapacity (illness), indicated the period of illness and the percentage of payment based on the employee’s length of service.

The program completely correctly calculated our average earnings and the amount of sick leave, and also divided this amount at the expense of the employer and at the expense of the Social Insurance Fund. Great!

Let's go into the calculation of average earnings (the "Change" button next to the calculated average earnings). A data entry window for calculating average earnings will open:

It shows the employee’s income for the previous 2 years and the calculated average earnings.

Let's click on the question mark next to the amount of average earnings to see the calculation itself in more detail. As you can see, the program even compares average earnings with the minimum wage:

Let's close the data entry window for calculating average earnings using the "OK" button and return to the open "Sick Leave" document. Find and click the “Calculate average earnings” button:

We will see a certificate calculating the average salary of an employee:

Finally, let’s run the “Sick leave” document using the “Post and close” button and see that it accrued sick leave, but did not accrue personal income tax.

Everything is correct. Personal income tax will be calculated in the final payroll document, which we will make last and which will include the sick leave accrued by us.

Create a payroll document for January and click the “Fill” button:

We see that the sick leave period is taken into account when calculating days and hours worked. The amount of sick leave was included in this month’s accruals. Personal income tax is assessed on this amount (as well as on the total salary). Amazing!

The payslip will look like this.

This is of great concern to subscribers and readers of our site. In their questions and suggestions, they repeatedly ask the question of calculating and accruing sick leave in the 1C program version 8.2.

Let us turn to the consideration of the stated topic using the example of calculating and accruing sick leave for an employee of the already known to us demonstration company Dobro LLC in the 1SBAccounting configuration for Ukraine 8.2.

First, we must check the directory “Plans for types of calculations” to see if it contains the type of accrual corresponding to sick leave. To do this, open 1C in mode 1:Enterprise and select the main menu item “Operations”, the button “Plans for types of calculations”. In the window that opens, select “Basic accruals of organizations.”

The directory that opens contains, as we remember, the types of accruals of organizations. In this case, we are interested in the elements responsible for sick leave sheets. Indeed, there are “doctors for entrepreneurship” and “doctors for social insurance”. We will use the first ones, so we will open the card of this element by double-clicking on the line.

The directory that opens contains, as we remember, the types of accruals of organizations. In this case, we are interested in the elements responsible for sick leave sheets. Indeed, there are “doctors for entrepreneurship” and “doctors for social insurance”. We will use the first ones, so we will open the card of this element by double-clicking on the line.

In the element “medicine for business” we fill in all the details as shown in the figure. This filling is quite sufficient for the most general case of accruing sick leave.

It is necessary to fill in both the data on the “General” tab and the data on the “Base for calculations” tab.

After filling out the details and checking their accuracy, close the card and directory. After this, open the journal of payroll documents. Next, we create and fill out a new document, similar to what was discussed in or in.

Naturally, after the salary was calculated, as in the case of vacation pay, sick pay was not automatically calculated. Let's add this view manually. We will enter the sick leave period, accrual type, base period, etc. We will definitely correct the changed base period back to the values corresponding to the month. Let's enter the amount; for example, let's take 125 UAH.

Naturally, after the salary was calculated, as in the case of vacation pay, sick pay was not automatically calculated. Let's add this view manually. We will enter the sick leave period, accrual type, base period, etc. We will definitely correct the changed base period back to the values corresponding to the month. Let's enter the amount; for example, let's take 125 UAH.

It is imperative to sequentially refill and recalculate the data on the remaining required tabs (“Contributions”, “Personal Income Tax”, “Payroll Contributions”) for this employee, in the same way as the parameters were calculated on the first tab. To do this, you need to select a tab, select an employee if the work is done with a payroll, and click “Fill”, then “Fill by employee”, then “Calculate” - “Calculate by employee”.

After checking the correctness of the calculated and filled in data, be sure to create transactions on the tab of the same name.

Click “Write” and “OK” and post the document. The accrual of sick leave and the calculation of related contributions and taxes are now complete. Next, you must make the payment using the “Salary Payable” document indicating the relevant types of payments.

Click “Write” and “OK” and post the document. The accrual of sick leave and the calculation of related contributions and taxes are now complete. Next, you must make the payment using the “Salary Payable” document indicating the relevant types of payments.

If you have any difficulties, we will definitely help.

If you have questions about the article or there are still unresolved problems, you can discuss them at

Rate this article:

15.05.2018 13:16:13 1C:Servistrend ru

Sick leave in the 1C program: Accounting 8.3

Calculation of temporary disability benefits, incl. maternity leave, in the 1C: Accounting 8.3 program is performed using the document “Sick Leave”. The calculation in the program is fully automated; the calculation of average earnings, benefit amounts and personal income tax is carried out directly in the document.

In this article, we will consider in more detail the operations of entering sick leaves and calculations, as well as printing accompanying certificates.

First, let's turn to the system settings, located along the path: Administration / Accounting settings / Salary settings. If the organization’s number of employees does not exceed 60 people, it is necessary to set the “Keep records of sick leave, vacations and executive documents” flag.

To register sick leave in the 1C accounting system: Accounting 8.3, follow the navigation path: Salary and Personnel / Salary / Sick Leave. The “Sick leave” document is located in the Salary section with other accrual documents.

By clicking the “Create” button on the action panel of the document list form, the person responsible for entering sick leave creates a new document “Sick Leave” for subsequent posting for payment.

- The date in the created document is set equal to the current system date;

- The system number will be assigned automatically at the time the document is recorded;

- Organization (set automatically from a previously established selection in the form of a list);

- Employee (the element is selected from the “Employees” directory).

The following block of information is filled out based on the sick leave received, namely:

- Number of certificate of incapacity for work;

- Type (primary or ongoing);

- Cause;

- Period (from... to);

- Violation note.

The “Experience” field is represented by a list of periods of insurance experience, changing which changes the percentage of the payment amount.

The amounts “Accrued”, “NDFL” and “To be paid” are calculated automatically in the document. By clicking on the “Accrued” amount link, the user has the opportunity to edit earnings for the previous 2 years, i.e. editing data that affects average earnings. Manual adjustments are necessary if the employee provided data from a previous place of work, as well as if it is necessary to change the periods included in the calculation. By clicking on the personal income tax amount link, you can view a detailed form for calculating income tax and control the correctness of the transfer.

To view document movements, click on the “Dt/Kt” button on the main form. In the window that opens, accounting and tax accounting entries, as well as other types of registers, will be presented for checking.

Using the “Calculation of average earnings” button on the form, the user can open a certificate of calculation for sick leave.

To print and save the report, you must click the “Print” and “Save” commands in the action bar.

If the provided sick leave is a continuation of the primary one, you must click the “Create based on / Sick leave” command from the primary document.

In this case, a new document will be created with the “Continuation” view and a link to the base document.

Still have questions? We'll tell you about registering sick leave in 1C as part of a free consultation!

Program 1C ZUP accrual of sick leave can be done through “Sick leave”. The “Sick Leave” document logs are available in the “Personnel” and “Salary” functional areas, using the “Sick Leave” link.

Before accruing sick leave in 1C, you need to check the correctness of the input, and, if necessary, establish the employee’s insurance record for paying sick leave. You can set it directly in the employee’s card by clicking on “Labor activity” (if this is not done, the “Sick leave certificate” will contain the message “The length of service is not filled out, benefits may be calculated incorrectly”).

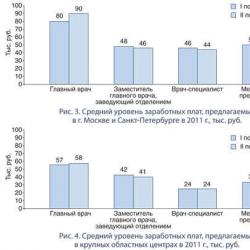

Fig.1

Average earnings, for calculating the amount of benefits, are calculated based on the salary for two years before. If an employee who worked for less than two years before falling ill went on sick leave, information about his earnings in previous places must be entered into the ZUP.

This information is inserted into the “Help for calculating benefits (incoming)” in the “Salary” functional area using the “Create” button.

Fig.2

The incoming certificate for calculating benefits indicates:

- Organization (if the information base maintains records for several organizations);

- The person for whom the certificate is issued;

- The period of work for which the certificate was issued;

- Name of the policyholder who issued the certificate;

- Amount of earnings, broken down by year, and number of sick/child care days, etc., broken down by year.

After filling out the certificate, click “File and close”.

After clicking on “Create” in the document log “Sick Leaves”, a new document form appears, in the fields of which you must enter the sick leave data:

- Organization (available if IB calculates salaries for several companies);

- The month in which the accrual is made;

- Sheet number (can be entered manually from the keyboard, downloaded from the Social Insurance Fund or from a file);

- If the sheet is an extension of the previous one, then you need to check the appropriate box and select the previous sheet;

- Select the cause of disability;

- Indicate the time for which the work exemption is valid;

- When a person received income for two years preceding illness and sick leave, then you need to enable the “Take into account the earnings of previous employers” checkbox;

- If the period of incapacity for work begins after the beginning of the month when the accrual occurs, then the payment - “in the interpayment period”, “with an advance” or the period of absence from work begins in the month following the month of accrual, then the “Accrue salary for...” checkbox becomes available. . When the checkbox is enabled, in addition to benefits, wages will be accrued for the days worked before the start of sick leave;

- If the option of additional payment for sick days up to the full average earnings is enabled in the accrual settings, then the “Pay up to” checkbox appears;

- Other fields (payment, payment date).

Fig.3

After filling out all the fields, the calculation results will be reflected in the “Accrued”, “Withheld” and “Average Earnings” sections. In the latter, you can click on the button with a pencil and when you open the “Entering data for calculation” form, change the calculation, for example, add the missing data from your previous place of work.

Fig.4

On “Payment” enter:

- Check the “Benefit accrual period” checkbox, otherwise the sick leave cannot be paid;

- The value of the start date of working ability is set automatically by the first date of the period of release from work of this sheet or the one of which it is a continuation;

- Payment percentage. The value of the percentage of payment is set automatically in accordance with the length of service for paying sick leave and can be changed;

- Benefit limitation. The benefit limit value is set automatically in accordance with legal requirements, but can be changed manually;

- We fill in other fields as necessary.

Fig.5

In “Accrued (detailed)” you will see accruals, their results, how many days were paid for each accrual, period and basis. After filling out the sick leave and checking the correctness of the calculations, click on “Record and post”.

“Sick leave” has the following printed forms:

- Calculation of benefits for the certificate of incapacity for work;

- Calculation of average earnings;

- Detailed calculation of charges.

The printable form “Calculation of benefits for a certificate of incapacity for work” will display the following information:

- Calculation of average and minimum average earnings from the minimum wage;

- The amount of benefits due both at the expense of the Social Insurance Fund and at the expense of the employer.

The printed average calculation form shows the following information:

- Earnings by year by policyholder;

- The calculation itself;

- Calculation of the minimum average earnings from the minimum wage.

The printed form “Detailed calculation of accruals” will display the following information:

- Earnings by year by policyholder;

- Calculation of average earnings to pay benefits;

- List of types of charges and the result of their calculation.

To get a printed form, you need to click on “Print” and select the one you need from the list provided.

Let’s imagine that the employee was on a business trip and his average salary was retained. If, upon returning from a business trip, he provided a certificate of incapacity for work, then when entering the sheet into the ZUP, the period of sick leave will be recalculated according to the settings of the accrual types.

Fig.6

Let’s say that an employee was sick in March, but provided a certificate of incapacity for work only in April. Then, for the period of absence in March, you need to enter the document “Absence (illness, absenteeism, no-show)” for the employee. When the certificate of incapacity for work is available, it will need to be entered into the ZUP and set the period of release from work when the employee was absent.

Then, in March, the employee was accrued benefits without taking into account earnings from previous employers, because when he was hired, he did not provide a certificate confirming this. He did this in April and needs to recalculate his benefits. To do this, you need to open the “Sick Leave” entered for March and click on the “Correct” link. A new sheet will appear in which you will need to enable the “Take into account the earnings of previous policyholders” checkbox, click on the edit button for average earnings, enter data from your previous place of work and post the document. After posting a new one, the previous document will not be available for editing. In the document form, the text “The document has been corrected and editing is prohibited” will be displayed in red.

How to calculate benefits for employees for temporary disability - “sick leave”

First, in the accounting settings of the 1C 8.3 program (see Main / Settings / Accounting parameters), you must enable the ability to record vacations, sick leave and executive documents.

Now in the accrual journal - the same place where documents on monthly payroll are created - you can create a document “Sick leave”.

- Number of certificate of incapacity for work.

- If this sick leave is a continuation of the previous one, the appropriate mark is placed and the required document is selected from the link.

- Cause of disability. Selected from the list proposed by the program - disease or injury; maternity leave, etc.

- Period of release from work. Dates are indicated according to the sick leave certificate.

- If there is a record of violation of the regime on the sick leave, the date of reduction in benefits should be indicated in this program document.

- Payment percentage. By default the program sets 60.00. The percentage can be changed if necessary.

- Amounts of accrued benefits and average earnings. They have already been calculated and filled out, based on the data available in the program about the employee’s earnings in the previous two years. According to current legislation, if the reason for sick leave was an illness or injury of an employee (except for injuries at work), the program pays for the first three days of incapacity at the expense of the employer, and for the remaining days - at the expense of the Social Insurance Fund.

Reflection of sick leave in payroll

At the end of the month, you will need to enter a payroll document in 1C. When it is filled in automatically, the total amount of accrued benefits will appear in the “Vacations/...” column. The same document will calculate and accrue personal income tax, immediately on wages and benefits (if the latter is subject to personal income tax).

The employee’s payslip (see Salaries and Personnel / Salary / Salary Reports) will reflect sick leave at the expense of the employer and at the expense of the Social Insurance Fund.

Accrual for sick leave in 1C Accounting 8.3

The 1C: Accounting 8.3 program, edition 3.0, allows an accountant to calculate temporary disability benefits to employees, which we usually call “sick leave”.

Previously, in the accounting settings of the 1C 8.3 program (see. Main / Settings / Accounting parameters) it is necessary to enable the ability to record vacations, sick leave and executive documents.

Now in the accrual journal - in the same place where documents for monthly payroll are created, you can create a “Sick Leave” document.

Creating a new sick leave in 1C 8.3 Accounting

In the header of the document, you should select the accrual month, registration date, and employee.

On the “Main” tab indicate:

- Sheet number disability.

- If given sick leave - continuation of the previous one, check the appropriate box and select the required document using the link.

- Cause of disability. Selected from the list proposed by the program - disease or injury; maternity leave, etc.

- Period of release from work. Dates are indicated according to the sick leave certificate.

- If there is a record of violation of the regime on the sick leave, this program document should indicate benefit reduction date.

- Payment percentage. By default the program sets 60.00. The percentage can be changed if necessary.

- Amounts of accrued benefits and average earnings. They have already been calculated and filled out based on the data available in the program about the employee’s earnings in the previous two years. According to current legislation, if the reason for sick leave was an illness or injury of an employee (except for injuries at work), the program pays for the first three days of incapacity at the expense of the employer, and for the remaining days - at the expense of the Social Insurance Fund.

Get 267 video lessons on 1C for free:

If there is no data on earnings in the program, the benefit is automatically calculated “at the minimum.” If necessary, an employee’s income for previous years can be specified manually by clicking on the “Change” link (next to the amount of average earnings).

In the form that opens, we see fields for entering monthly earnings for the two previous calendar years. The accountant can fill out these amounts both on the basis of his own data (if the employee was working in the organization at that time, but there was no accounting in 1C yet), and on the basis of the provided certificate of earnings from the previous employer. The 1C Accounting program will automatically calculate the amount of average daily earnings, which will be transferred to the sick leave by clicking “OK”.

The type of benefit limitation must be indicated on the “Additional” tab of the sick leave certificate. By default, the limit is set to the maximum value of the base for calculating insurance premiums; options are also available “in the amount of MMOT” or according to the maximum amount of the monthly insurance payment.

Here, if necessary, you can indicate the regional coefficient (in format 1.XX) and the benefits applied.

The “Accruals” tab displays accruals, their results and period. Amounts are available for manual modification; in this case, the edited result will be displayed on the “Main” tab.

When posting, “Sick Leave” performs movements on accounting accounts, or postings. The program assigns the amount of the benefit at the expense of the employer to the same accounting account as the salary of this employee (according to the existing settings), in correspondence with the account loan. 70. The amount of the benefit at the expense of the Social Insurance Fund is debited to account 69.01 “Social insurance payments”.