Changes in the lives of Russians from October 1. Military pensioners stand for Russia and its armed forces. Retirement for pensioners

MOSCOW, February 21 - PRIME. Russians are more pessimistic than the average population of the Earth about the prospects for the economic situation this year, however, citizens do not expect a serious deterioration in the economy: almost half of the residents of the Russian Federation believe that from an economic point of view, 2018 will be the same as last year, says a study by the International Association of Independent Research Agencies Gallup International, which is available to RIA Novosti.

In November-December 2017, Gallup conducted an annual “Year-End” survey among people from different countries, which was dedicated to the results of the outgoing year. As part of the project, almost 54 thousand people were surveyed in 55 countries. The survey in Russia was conducted by the Romir research holding; as part of the study, 1.5 thousand respondents were interviewed from a national representative sample.

“When asked, “What do you think 2018 will be like economically?” just over a quarter of global respondents (28%) said it will be a year of economic prosperity. This is a dramatic decline from the year before. when 42% of the world’s population expected positive economic changes in 2017,” the study says.

At the same time, the report adds, the number of negative assessments of the previous year was 22%, while in 2017 it increased to 30%. In addition, the share of those who believe that 2018 will be the same as last year from an economic point of view has increased to 36% from 31%.

As a result, the global index of economic hope - it is calculated as the difference between positive and negative responses - according to the results of last year's survey became negative and amounted to minus 2 percentage points. A year earlier it was 20 percentage points. “Thus, at the end of 2017, the share of economic optimists was less than the share of economic pessimists,” Gallup concludes.

STABILITY OF EXPECTATIONS IN RUSSIA

If we consider the results of the study in Russia, only 14% of Russians believe that 2018 will be a year of economic prosperity. A year earlier, the share of optimists was 17%. Another 30% of respondents, as in the previous survey, believe that the current year will bring economic problems. Finally, almost half of Russians (49%) believe that 2018 will be the same as the previous one.

“As for the dynamics of economic assessments of Russian residents over the past five years, after a peak of 33% of positive expectations in 2015, a forecast decline can be observed. At the same time, the share of negative assessments is declining after a record value of 54% obtained at the end of 2013. Gradually, the share of responses about economic problems decreased and stabilized at 30%,” the release says.

“But the number of opinions supporting the judgment that next year will be the same as last year has increased and amounted to 49%. Thus, almost half of Russians who took part in the survey tend to see a certain stability in the country’s economic policy,” the study adds .

According to the results of a survey at the end of 2017, the index of economic hope in Russia was minus 16 percentage points. A year earlier it was minus 14 percentage points, and in 2015 the figure was positive and amounted to 6 percentage points.

“The mood of Russians is quite natural. No major changes occurred in 2017 and are not expected even against the backdrop of the March elections. That is why there is an increase in conservative assessments in the answers of respondents from Russia,” says Andrei Milekhin, vice president of Gallup International, whose words are quoted in release.

WORLD SITUATION

Based on the results of the survey, a list of the most optimistic and pessimistic countries from an economic point of view was also compiled. In general, the countries of Africa look at the economic situation with the greatest optimism, then the countries of South Asia and Oceania, and the countries of Western Asia in third place.

The leader in the ranking according to the economic hope index was Nigeria (the indicator is 59 percentage points), Vietnam was in second place (55 percentage points), and Indonesia was in third (53 percentage points). India ranks fourth in the ranking of optimistic countries (46 percentage points), and the Philippines ranks fifth (32 percentage points).

According to the 2017 survey, the most pessimistic country was Italy (minus 50 percentage points), followed by Greece (minus 43 percentage points). They are followed by Turkey (minus 40 percentage points), Ukraine and Iran (minus 38 percentage points each).

“Military actions and the tense situation in the Middle East have led to a sharp drop in the index of their economic hope. On the contrary, in the countries of Western and Eastern Europe there are prospects for stabilizing destructive economic processes, which is reflected in the small but growth of the global economic index of these countries, although not yet still in the negative zone,” Milekhin noted.

On October 1, 2017, several regulations affecting the lives of different categories of Russian citizens will come into force. Who and what to expect this fall?

Autumn conscription

In October, the autumn conscription into the Armed Forces of the Russian Federation begins, which will last until the end of the year. Young men aged 18 to 27 years whose deferment has expired or those who were unable to enroll in higher education institutions will be drafted into the army.

Persons with a criminal record, permanent residents of other countries, those undergoing alternative service or having completed military service in foreign armies, holders of scientific degrees and some other categories of citizens are not subject to conscription.

A temporary deferment from military service can be applied for by persons who are studying in various educational institutions, including graduate school, who have received a medical certificate about temporary health problems, and guardians of young children.

Fathers with many children and single fathers with a young child are exempt from military service. fathers of disabled children under the age of 3 years.

Beneficiaries – choice of social services

By the end of September, beneficiaries must decide in what format they will receive federal assistance. The set of social services (SSS) includes the provision of medicines, medical nutrition, sanatorium-resort treatment, and reimbursement of transportation costs for travel to out-of-town medical institutions. The total amount of the service package is 1048 rubles. per month, while each specific service has a fixed cost.

Beneficiaries, which include disabled people and WWII participants, combatants, survivors of the siege of Leningrad, disabled people and children with disabilities, people affected by radioactive exposure, have the opportunity (until October 1) to decide on the form of social assistance. Each of them can take advantage of all the services offered, receive the cash equivalent of the NSO, or combine services, receiving some of them in kind and others in the form of monetary compensation.

By the beginning of October, new beneficiaries had to submit an application to the Pension Fund to receive NSS from the beginning of next year, as well as those who already use social assistance, but would like to change the format of receiving services.

If you did not manage to apply for social assistance before October 1, there is information on the Pension Fund website that will tell you what to do in this case.

Retirement for pensioners

In July this year, a law was passed that limits the age limits for certain positions. The law comes into force from the first days of October. According to it, the age of chief doctors of municipal and private medical institutions and their deputies should not exceed 65 years. At the same time, they can continue to work in other positions that correspond to their qualifications.

True, if the staff of a medical institution decides to leave its managers in their previous places, then the age threshold may be shifted to 70 years.

In 2018, Russians can expect dozens of changes - a new tax deduction, payments for the first child, a ban on alcoholic drinks and much more. What will hit Russians’ wallets, and what, on the contrary, will replenish it - Lenta.ru figured out what innovations await Russians in 2018.

WORLD indexing

In 2018, the salaries of all state employees will be transferred to the national Mir payment cards. At the same time, public sector employees will be able to simultaneously use several cards by linking them to their salary account.

By the end of 2017, more than 25 million cards had been issued, more than half of them for public sector employees. They can be used mainly in Russia, but the National Payment Card System promised to bring Mir to the international level. The authorities expect that all social payments will be transferred to Mir system cards by mid-2020.

According to the May decrees of the president, in 2018 the salaries of doctors, teachers, paramedical and junior medical staff, social workers, scientists and cultural figures and other public sector employees increased by 4.1 percent. As Deputy Prime Minister for Social Affairs Olga Golodets noted, doctors’ salaries in January should be twice as high as the national average. It is also planned that medical staff will receive a full average salary.

At the end of 2017, the salary of most doctors was less than the national average (in October it was 38,275 rubles). Only 8 percent of doctors earned 50 thousand or more.

In the wake of indexations, the government for the first time since the end of 2013 decided to raise the salaries of officials, civil service employees and government agencies by 4 percent “in order to ensure social guarantees.” For example, deputies, senators, ministers and judges will receive an increase. Until the end of the year, only the head of state, prime minister and officials from the presidential administration will receive a 10 percent salary reduction.

According to Rosstat, in 2016 the average monthly salary of officials was 115.7 thousand rubles. Employees of the government apparatus received 228.5 thousand, employees of the Accounts Chamber - almost 181 thousand, senators - 176 thousand, deputies - 155 thousand rubles.

Almost all types of pensions will be increased: old age, disability and loss of a breadwinner. The exception is payments to working pensioners: as in previous years, they will remain at the same level.

Insurance pensions for non-working pensioners will increase by 3.7 percent in January, according to the website of the Pension Fund of Russia (PFR). The cost of one pension coefficient will be 81.49 rubles (in 2017 - 78.58 rubles), and the fixed payment will be almost 4983 rubles. Non-working elderly people will also receive an additional payment if their pension is lower than the subsistence level of pensioners in their region of residence. Payments to pensioners from among the indigenous peoples of the North will increase by almost 1.5 thousand rubles. The Pension Fund predicts the average pension in the country at just over 14 thousand.

At the same time, according to the head of the Ministry of Labor Maxim Topilin, on April 1 pensions will increase by 4.1 percent, which is significantly higher than the projected inflation rate (2.6 percent). However, this coefficient may be revised in March, immediately before indexation.

Indexation of all social payments, benefits and compensations by 3.2 percent will begin on February 1. In particular, monthly payments to beneficiaries and families with children will be indexed. Expenses for this are provided for in the draft federal budget.

From the beginning of the year, the social pension for children who have lost one of their parents will increase by almost 1.5 thousand rubles. If two parents are lost, the minor will receive not 7.2 thousand, but 10 thousand. Group I disabled people since childhood and disabled children will receive 13 thousand instead of 8.7 thousand rubles monthly.

A new type of pension will appear - for abandoned and abandoned children. We are talking primarily about foundlings who did not receive survivor benefits due to the fact that legally they never had parents. There are about four thousand such children in Russia. Every month until they reach the age of 18, they will receive a little more than 10 thousand rubles, and if they enter a university as a full-time student, the benefit will remain until they are 23 years old.

Socio-demographic leap

In March 2017, Deputy Prime Minister Olga Golodets instructed the Ministry of Health to create a register of patients who need strong painkillers with narcotic drugs. It should go live on January 1 and make life easier for many seriously ill people, such as cancer patients.

As part of a large-scale demographic reform in the country, Russians will be able to receive monthly payments for their first child, who will be born or adopted no earlier than January 2018. Over three years, the state will spend almost 145 billion rubles for these purposes. The initiative may affect every second childless family.

The average benefit in the country is about 10.5 thousand rubles, and in the capital - just over 14 thousand. It will be available to parents whose total monthly income does not exceed 1.5 times the subsistence level of the working-age population in the region of residence for the second quarter of the year preceding the application for payments. For example, a Moscow family can count on benefits in 2018 if its members collectively earn no more than 28.1 thousand per month. Parents will have to contact the social security authorities themselves.

The government has decided to extend the maternity capital payment program for three years - until December 31, 2021. It was previously planned that it would end at the end of 2018. According to the new law, which the State Duma unanimously adopted on December 21, 2017, maternity capital can be spent on paying for preschool education. The document will come into force after signing by the president.

My battery is almost done

On January 1, Russia abandoned alcoholic energy drinks - a ban began to apply on the production and sale of tonic drinks that contain less than 15 percent of the total ethyl alcohol. The only exception is the production of such drinks for export. In fact, the Russians were left without the popular Jaguar and Strike.

The law will not radically change the situation with alcohol drinks in the country, since regional authorities have the right at the subject level to establish additional restrictions on the time, conditions and places of retail sale of alcohol, including introducing a complete ban on its sale. In particular, since 2015, laws banning or restricting the sale of low-alcohol energy drinks have been adopted in 67 regions.

However, in a number of regions the bans had to be lifted due to the decision of the Supreme Court, which ruled that such restrictions can only be established at the federal level. After this, a number of regions turned to the Constitutional Court for clarification. The new law put an end to the dispute around alcoholic drinks and banned them throughout the country.

We've arrived

From January 1, tax rates on excisable goods increased in Russia - the excise tax on gasoline and diesel fuel was added by 50 kopecks. Another increase in the excise tax - also by 50 kopecks - awaits residents of the country in July. In addition, excise tax rates for passenger cars have changed depending on engine power.

For some expensive cars worth up to 5 million rubles not older than three years, when calculating transport tax from 2018, a single increasing factor of 1.1 is established. Previously, the coefficients were 1.1, 1.3, and 1.5, depending on the year of manufacture of the car.

On January 1, 2018, new rules for issuing compulsory motor third party liability insurance (MTPL) came into force. A two-dimensional QR code will appear in the electronic MTPL policy, confirming the presence of compulsory insurance and containing details of the contract with the insurance company.

New road signs may appear in Russia in 2018. The design studio of Artemy Lebedev will develop their appearance. Possible signs include: “Attention, there is an unmanned vehicle in the area,” “The beginning of a road section with an unmanned vehicle,” and “The end of a road section with an unmanned vehicle.” In 2018, they will be installed on roads where drones are being tested.

While everyone is at home

In 2018, a law will come into force that will protect the rights of shareholders in a situation where the developer has gone bankrupt. Created in 2017, the Fund for the Protection of the Rights of Citizens - Participants in Shared Construction will be able to finance unfinished shared construction or reimburse victims for the invested funds: the organization, at the expense of mandatory contributions from developers, must form a compensation fund from which money will be allocated. It is planned to create a unified register of developers.

The law also requires that the equity capital of the company constructing the house be at least 10 percent of the cost of the project, and that the developer organization does not include employees with an unexpunged criminal record on economic charges.

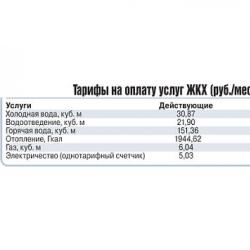

The Federal Antimonopoly Service has established minimum and maximum levels of electricity tariffs. The tariffs themselves are determined by regional authorities, but the agency has published a table of tariffs by region. Electricity price indexation is envisaged from the second half of the year - it will amount to 5 percent of the maximum tariff level.

Nightmares for business and election caresses

Since the beginning of 2018, the procedure for providing citizens with tax benefits on transport and land taxes, as well as on property tax for individuals, has been simplified, according to the website of the Federal Tax Service. Now a person does not have to document his right to benefits - just fill out the appropriate application and indicate in it the details of the title document. Tax officials will be able to obtain all other information independently from authorities and organizations, which must respond to the request within seven days.

In 2018, organizations will again begin to pay tax on movable property (vehicles, securities, shares in a business, etc.), and the federal benefit will disappear. The maximum rate for this tax should not exceed 1.1 percent of the property value in 2018, and 2.2 percent in 2019. However, the regions were left with the right to decide whether to provide benefits (including tax exemptions) to companies or not, as well as to set reduced rates. The decision will affect movable property, from the date of issue of which no more than three years have passed, as well as innovative equipment.

In Russia, from January 1, 2018, an investment tax deduction from income tax was introduced (it is 20 percent - 2 percent is deducted to the federal budget, 18 percent to the regional budget). When purchasing equipment, modernizing or reconstructing production, the company will be able to receive from the portion of the tax going to the regional budget a deduction not exceeding 90 percent of the costs of completion, modernization, and technical re-equipment. For the part of the income tax that must be credited to the federal budget, the tax deduction cannot exceed 10 percent. Under certain conditions it can be reduced to zero. It is planned that the benefit will be valid until December 31, 2027.

In particular, foreign companies, residents of free economic zones and organizations participating in regional investment projects are deprived of the right to use the deduction.

In 2018, supervisory authorities received a new system of business inspections. Scheduled inspections will be carried out according to a special checklist with a list of control questions. This was done to increase the transparency of the activities of control and supervisory authorities. From January 1, checklists will be used during scheduled inspections of employers classified as moderate risk, and from July 1, the system will cover all employers.

The number of scheduled business inspections planned by supervisory authorities for 2018 decreased by 10 percent. In total, on average, half a million scheduled inspections and about one million unscheduled inspections are carried out in Russia per year, but the country’s president has ordered to reduce the number of the latter to 30 percent of the planned ones.

Macroeconomic innovations

A new budget rule will come into effect in the country in 2018, according to which additional oil and gas revenues (all oil and gas revenues when the oil price is above $40 per barrel) will be sent to reserves. The use of this rule is expected to make it possible to achieve a deficit-free budget in 2019, provided that Urals oil prices are at $40 per barrel. At the same time, the non-oil and gas budget deficit will decrease from 9.1 percent of GDP last year to 5.8 percent in 2020.

In 2018, the new Customs Code of the Eurasian Economic Union (the organization includes Russia, Belarus, Kazakhstan, Kyrgyzstan and Armenia) came into force. The document envisages simplification of customs procedures, reduction of customs clearance times and the use of a “single window” mechanism, which eliminates the need to provide documents to several authorities at once related to the admission of goods for domestic consumption. The document also provides for the transfer of all customs procedures to electronic format.

We are waiting for guests

In Russia, a tax free system was launched in the new year, which will allow foreigners who are not citizens of the Eurasian Economic Union to return VAT on purchases made in Russia when they leave the country. To do this, during the day in one store you need to buy goods worth at least 10 thousand rubles, including tax.

To receive a tax refund, you will need to issue a special check at the store and receive a stamp from customs indicating the export of goods purchased in Russia. After this, within a year from the date of purchase, the foreigner can apply for a refund. However, there is a nuance: a tax refund cannot be issued for excisable goods, but in the case where a VAT refund is possible, the tourist must take the purchase out of Russia within three months. The introduction of the system should make Russia attractive to tourists, especially on the eve of the 2018 FIFA World Cup.

Choosing the format of a set of social services for beneficiaries, autumn conscription into the army, increasing the “restriction” threshold for debtors, amendments to the Law of the Russian Federation “On the Protection of Consumer Rights”.

And also about VAT and Tax free, a new column in invoices, an age limit for chief doctors and their deputies and other innovations from October 1, 2017.

The deadline for choosing the format of a set of social services for beneficiaries is ending

Until October 1, federal beneficiaries who are eligible to apply for state assistance had to officially indicate in what form they would like to receive the so-called set of social services (NSS).

According to the Russian Pension Fund, the cost of a set of services since the beginning of 2017 is 1048.97 rubles. per month . It includes the provision of medicines or nutritional therapy, sanatorium treatment, and transportation costs to the place of treatment.

What will change in Russia from January 1, 2018 >>

It can be applied for, among other things, by disabled people and participants of the Great Patriotic War, blockade survivors, combatants, disabled people and children with disabilities, people affected by radiation, and blood donors.

If desired, the beneficiary can use the actual services offered, receive monetary compensation for them (each service has a fixed monetary equivalent, not exceeding the total cost of the set) or use part of the services, and receive monetary compensation for the remaining ones.

Indexation of scholarships, simplified procedure for issuing Russian citizenship to Ukrainians, Belarus will increase export duties on oil, petroleum products and much more >>

So, once again: Federal beneficiaries who are entitled to a set of social services (NSS) can receive it in kind or in cash if they wish.

If a pensioner has decided on the form of receiving a set of social services during 2008-2016, then the application should not be submitted again, since it is valid until the federal benefit recipient changes his decision.

If a beneficiary wants to change the form of receiving NSU or the pensioner has the right to receive it for the first time this year, then the application can be submitted by October 2, 2017 inclusive to the Pension Fund Administration at the place of residence, the MFC office, or submitted electronically on the website of the Pension Fund of Russia .

And one more thing: from February 1, 2018, daily payments to beneficiaries will increase by 2.5 percent. In addition, the set of social services (NSS) included in the EDV will be indexed by 2.5%. The cost of a set of social services will be 1,075 rubles 19 kopecks per month, including provision of necessary medications - 828 rubles 14 kopecks, provision of a voucher for sanatorium treatment for the prevention of major diseases - 128 rubles 11 kopecks, free travel on suburban railway transport, and also on intercity transport to the place of treatment and back - 118 rubles 94 kopecks.

On September 27, President Vladimir Putin signed a decree calling up 134,000 people for military service from October 1 to December 31, 2017. Citizens aged 18 to 27 years who “are not in the reserves” and are subject to conscription “in accordance with the law” are subject to conscription for military service. About conscription and military service».

15,000 conscripts were trained in military specialties in DOSAAF (Voluntary Society for Assistance to the Army, Aviation and Navy -) of Russia and secondary vocational education organizations. The recruitment of scientific and sports companies will continue. Currently, there are 12 scientific companies, in which 648 people serve, and four sports companies, in which 381 people serve.

Last year, the President signed a decree calling up 152,000 people for military service. A significant reduction occurred as a result of filling the positions of privates and sergeants with military personnel serving under contract.

The call will last until December 31 of this year. It applies to young people aged 18 to 27 years old - first of all, in the fall, those who did not go to college in the summer and did not apply for a deferment from the army for study are joining the army.

An exception will be made for residents of a number of territories of the Far North (for them the conscription will begin in November), residents of rural areas engaged in harvesting at this time, provided that this fact is documented (for example, in their work record book). In addition, young male teachers are not subject to the autumn conscription due to the fact that the school year begins only a month earlier - teachers are only subject to the spring conscription.

Who can buy a new home with a mortgage at six percent >>

Among those who are not subject to conscription at all are convicts, young people performing alternative civilian service, permanently residing outside the territory of Russia, those who served in another country, holders of an academic degree, and a number of other categories of citizens. Reasons that will allow you to apply for a deferment: studying at school, vocational school, college, university or graduate school, guardianship of young brothers and sisters (in the absence of other guardians), temporary health restrictions. Also, fathers with many children, single fathers raising a young child, and fathers of disabled children under three years of age are not subject to conscription. You can view the full list of criteria.

Among those who are not subject to conscription at all are convicts, young people performing alternative civil service, permanently residing outside the territory of the Russian Federation, those who served in another country, holders of an academic degree, and a number of other categories of citizens.

Everyone who will be drafted into the army from October to December 2017 will have to serve for one year.

Driver's joy

Positive news awaits drivers at the beginning of October who are not particularly careful in driving, but who often travel abroad: the total amount of fines for traffic violations, after which travel restrictions are imposed, will be increased.

Changes to traffic regulations have been approved in Russia >>

If now a trip abroad can be disrupted if the amount of fines reaches 10,000 rubles, now this threshold is raised to 30,000 rubles.

Amendments to the Law of the Russian Federation “On the Protection of Consumer Rights” will come into force on October 1, 2017.

Federal Law No. 88-FZ of May 1, 2017 amends Article 16.1 of the Law of the Russian Federation No. 2300-1 of 02/07/92 “On the Protection of Consumer Rights,” which establishes the forms and procedure for payment for the sale of goods (performance of work, provision of services).

The new version of paragraph 1 of Article 16.1 of the Law provides for the obligation of business entities whose revenue for the previous calendar year exceeds 40 million rubles to ensure the use of national payment instruments.

How to register ownership of a local area >>

At the same time, the law provides for two cases when a subject is exempt from providing the possibility of paying by card:

1) payment for goods (works, services) is carried out in a place where access services to mobile radiotelephone communications and (or) means of collective access to the information and telecommunications network "Internet" are not provided;

2) revenue from the sale of goods in a specific retail facility amounted to less than 5 million rubles for the previous calendar year.

For failure to comply with legal requirements, liability is provided under Part 4 of Art. 14.8 of the Code of Administrative Offenses of the Russian Federation, which entails sanctions in the form of an administrative fine:

For officials - in the amount of 15,000 to 30,000 rubles;

For legal entities - from 30,000 to 50,000 rubles.

VAT and Tax free

Foreigners will now be able to return part of the cost of goods exported from the Russian Federation. From October 1, a tax free system will be launched in Russia, which will allow you to return the value added tax (VAT) on goods purchased in the country after departure. In this way, you can return 18% of the total amount, but the operator company will deduct a percentage from it for its services.

In this way, you can return 18% of the total amount, but the operator company will deduct a percentage from it for its services.

The cost of preparing and launching this system amounted to about 260 million rubles. Citizens of countries that, along with the Russian Federation, are members of the Eurasian Economic Union: Kazakhstan, Belarus, Armenia and Kyrgyzstan will not be able to use it.

The second arch of the Crimean Bridge is being moved to the piers >>

Another innovation related to VAT concerns transactions related to critical and life-saving medical products. From now on, value added tax will not be levied on financial leasing services for essential and vital medical products.

Reason: Federal Law No. 161-FZ of July 18, 2017 (amended Article 142 of Part Two of the Tax Code).

Transactions for the sale of services for the transfer of prosthetic and orthopedic products, raw materials for their manufacture and semi-finished products for them, having the appropriate registration certificate, under financial lease agreements with the right to purchase will not be subject to VAT. Previously, the delivery of vital medical supplies was not subject to tax. products for rent, but in case of purchase, VAT had to be paid in full.

Services for the sale of entrance tickets and passes to visit aquariums are also exempt from VAT.

New column in invoices

Another innovation will affect legal entities and individual entrepreneurs. A new column will appear in invoices from October 1: “Product code”. It applies, first of all, to those who trade with the countries of the Eurasian Economic Union; for the rest, it is enough to put a dash in the column.

In addition, organizations will now have to indicate their full address according to the Unified State Register of Legal Entities (Unified State Register of Legal Entities) in invoices. Until now, in such cases it was possible to limit oneself to the wording from the charter, which often came down only to the city in which the enterprise is located.

Since October 2017, companies that do not provide a full address on an invoice may subsequently be denied a tax deduction.

From October 1, 2017, penalties for late tax payments will be assessed according to new rules. Such changes were made by Federal Law No. 401-FZ of November 30, 2016 to paragraph 4 of Article 75 of the Tax Code.

How does paragraph 4 of Article 75 of the Tax Code of the Russian Federation “sound” now? Today the text of this paragraph is as follows: “the penalty for each day of delay is determined as a percentage of the unpaid tax amount. The interest rate of the penalty is taken equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time.”

A unique gas carrier crossed the Northern Sea Route in record time >>

The new version of paragraph 4 of Article 75 of the Tax Code of the Russian Federation - “The penalty for each calendar day of delay in fulfilling the obligation to pay tax is determined as a percentage of the unpaid amount of tax.

The interest rate of the penalty is assumed to be equal to:

– for individuals, including individual entrepreneurs – one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

– for organizations:

1) For delay in fulfilling the obligation to pay tax for a period of up to 30 calendar days (inclusive) - one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time;

2) For delay in fulfilling the obligation to pay tax for a period of more than 30 calendar days - one three hundredth of the refinancing rate of the Central Bank of the Russian Federation, valid for the period up to 30 calendar days (inclusive) of such delay, and 1/150 of the refinancing rate of the Central Bank of the Russian Federation, valid in period starting from the 31st calendar day of such delay.”

Main construction site of SIBUR >>

What arrears are covered by the new amendments? According to the new rules, the amount of the penalty should be calculated in relation to arrears that were formed after October 1, 2017, because the amendments also come into force on October 1, 2017.

1) If a company or individual entrepreneur is overdue for a tax payment by up to 30 calendar days (inclusive), the calculation is based on 1/300 of the refinancing rate in force at that time;

2) If a company or individual entrepreneur is overdue for a tax payment for a period of more than 30 calendar days (inclusive), the calculation is based on 1/300 of the refinancing rate in effect for the period up to 30 calendar days (inclusive) of the delay, and 1/150 of the refinancing rate in effect starting from from the 31st calendar day of delay.

Young people are treasured everywhere; old people are honored everywhere.

Chief doctors and their deputies can now not be older than 65 years. This age limit is established by a law adopted in July 2017 - its effect applies to both state and municipal medical institutions.

Upon reaching the specified age, persons holding the positions of managers and deputy managers are transferred, with their written consent, to other positions corresponding to their qualifications.

Tekhmash has mastered the production of anti-radiation cosmetics >>

In addition, the tenure of the head of a medical institution can be extended to 70 years by the founder upon the proposal of a general meeting (conference) of employees of the specified medical organization. In turn, the head of the medical organization “ has the right to extend the term of office of his deputy or head of a branch until he reaches the age of 70 years in the manner established by the charter of the medical organization».

At the same time, employment contracts concluded with the heads of medical organizations and their deputies, who “ reached the age of 65 years on the date of entry into force of the law or reach the age of 65 years within three years from the date of entry into force of the Federal Law, remain in effect until the expiration of the terms provided for by these employment contracts, but no more than for three years from the date of entry into force of the law force».

The implementation of the new norm will allow experienced medical workers to “ focus on medical practice, on educating students, creating your own scientific school" In addition, there is a problem of career growth for young professionals who, due to the fact that “ personnel elevator is closed", are leaving state and municipal clinics for private ones.

Amendments to the federal weapons law come into force

The Russian National Guard notifies that on October 1, 2017, Federal Law dated July 1, 2017 No. 151-FZ “ On amendments to the Federal Law“On Weapons” and Federal Law of July 1, 2017 No. 145-FZ “ On amendments to Article 333.33 of Part Two of the Tax Code of the Russian Federation».

Sniper rifle T5000 >>

Changes have been made to the weapons law. The validity period of the license to purchase weapons and ammunition has not changed. It is 6 months from the date of issue. Licenses for exhibiting and collecting weapons and ammunition are valid indefinitely.

Control shooting of civilian firearms with a rifled barrel is carried out to form a federal bullet cartridge collection. In particular, weapons stored and used by enterprises, organizations and institutions are subject to control shooting. It is clarified that shooting is carried out upon renewal of storage, storage and use permits - once every 15 years, and not every 5 years, as was previously provided.

WATCH THE VIDEO:

What Artek became Reconstruction of Crimea Construction of the Crimean Bridge August 2017 MS-21 aircraft

11:00 27.09.17

What will change for Russians from October 1, 2017?

What awaits Russians from October 1, 2017? What legislative changes do you need to know? All the answers are in our material.

Autumn call

October 1, 2017 autumn conscription begins, which will last until December 31 this year.

An exception will be made for residents of a number of territories of the Far North (for them the conscription will begin in November), residents of rural areas engaged in harvesting at this time, provided that this fact is documented (for example, in their work record book). In addition, young male teachers are not subject to the autumn conscription due to the fact that the school year begins only a month earlier - teachers are only subject to the spring conscription.

Reasons for applying for a deferment: education at school, vocational school, college, university or graduate school, guardianship of young brothers and sisters (in the absence of other guardians), temporary restrictions for health reasons. Also, fathers with many children, single fathers raising a young child, and fathers of disabled children under three years of age are not subject to conscription. You can view the full list of criteria here.

Among those who are not subject to conscription at all are convicts, young people performing alternative civil service, permanently residing outside the territory of the Russian Federation, those who served in another country, holders of an academic degree and a number of other categories of citizens.

Everyone who will be drafted into the army from October to December 2017 will have to serve for one year.

Set of social services

Until October 1 federal beneficiaries who are eligible to apply for government assistance were required to officially report in what form would they like to receive so-called set of social services(NSU).

According to the Russian Pension Fund, the cost of a set of services since the beginning of 2017 is 1,048 rubles per month. It includes the provision of medicines or nutritional therapy, sanatorium treatment, and transportation costs to the place of treatment.

Disabled people and participants of the Great Patriotic War, blockade survivors, combatants, disabled people and children with disabilities, and people affected by radiation can apply for it.

If desired, the beneficiary can use the actual services offered, receive monetary compensation for them (each service has a fixed monetary equivalent, not exceeding the total cost of the set) or use part of the services, and receive monetary compensation for the remaining ones.

Those who first received the right to apply for NSU had to submit an application to the Pension Fund by October 1 in order to begin receiving the desired set from January 1, 2018. In addition, those who would like to change the form of receiving the kit had to submit an application.

Fines and abroad

Good news at the beginning of October awaits drivers who are not very careful in driving, but who often travel abroad.

From October 1, 2017, the total amount of fines for traffic violations, after which travel restrictions are imposed, will be increased. If now a foreign trip can be disrupted if the amount of fines reaches 10 thousand rubles, now this the threshold is increased to 30 thousand rubles .

What's New in Invoices

Another innovation will affect legal entities and individual entrepreneurs. A new column will appear in invoices from October 1: “Product code”. It applies primarily to those who trade with the countries of the Eurasian Economic Union; for the rest, it is enough to put a dash in the column. In addition, organizations will now have to indicate their full address according to the Unified State Register of Legal Entities (Unified State Register of Legal Entities) on invoices. Until now, in such cases it was possible to limit oneself to the wording from the charter, which often came down only to the city in which the enterprise is located. Since October 2017, companies that do not provide a full address on an invoice may subsequently be denied a tax deduction.

Chief doctors will look younger

Chief doctors and their deputies can now not be older than 65 years. This age limit was established by law, adopted in July 2017, and applies to both state and municipal medical institutions. According to it, after reaching the age of 65, chief doctors are proposed to be transferred to other positions corresponding to their qualifications. However, the age threshold for a particular manager can be increased to 70 years if such a decision is made by the team of the medical institution. The law comes into force on October 1.